Effective bookkeeping methods are essential for success in the fast-paced business of real estate, where transactions move quickly and details matter. Without a solid grasp of your finances, managing the complexities of property investments can become difficult. Keeping comprehensive records assures compliance and gives useful information about your financial health and operational effectiveness. Whether you’re an experienced real estate investor or just starting, understanding the art of real estate bookkeeping may significantly improve your bottom line.

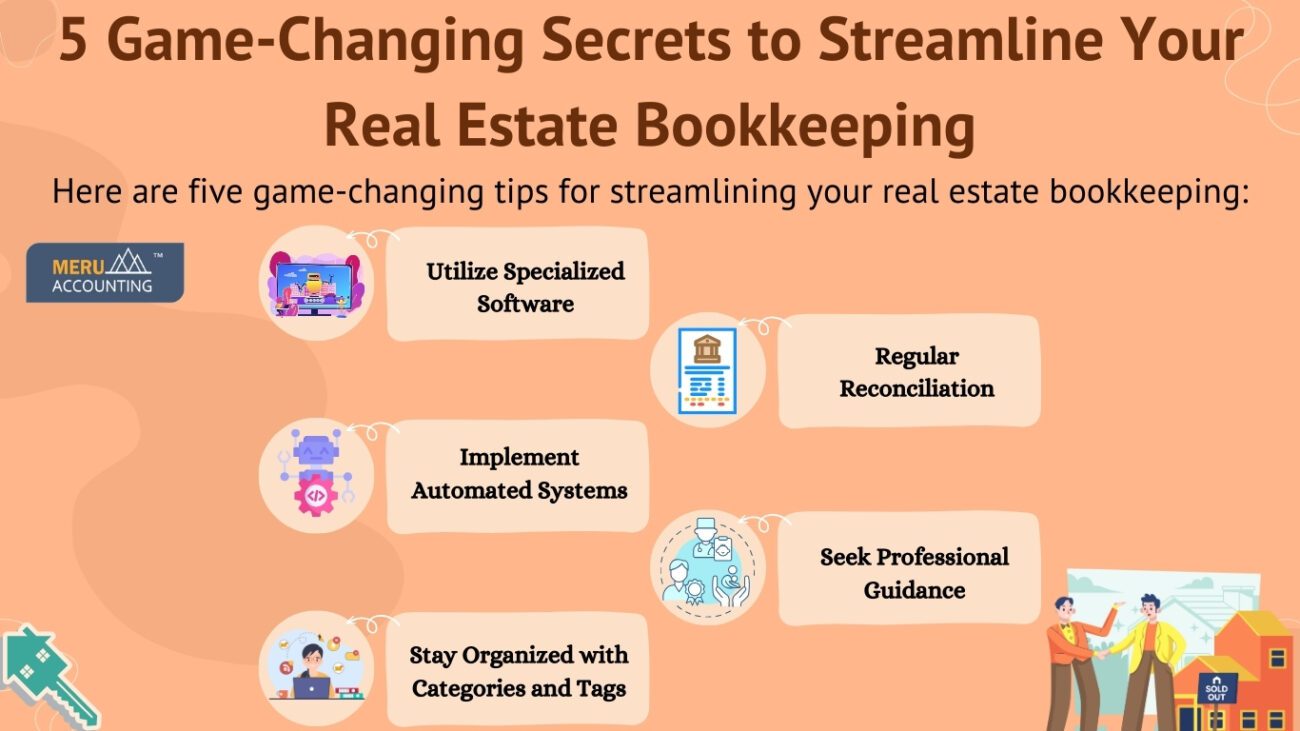

Here are five game-changing tips for streamlining your real estate bookkeeping:

1. Utilize Specialized Software: When it comes to real estate bookkeeping, generic accounting software may fall short in meeting your specific needs. Invest in specialized software designed explicitly for real estate management. These platforms offer features customized to property management, such as tracking rental income, managing expenses, and generating detailed reports. By using such software, you can streamline your real estate bookkeeping processes, minimize errors, and gain better control over your finances.

2. Implement Automated Systems: Manual data entry is not only time-consuming but also prone to errors. Embrace automation to simplify your bookkeeping for real estate. Set up automatic bank feeds to import transactions directly into your accounting software. Use recurring billing features to automate rent collection and expense payments. Additionally, consider implementing electronic document management systems to digitize and organize your financial records. By automating routine tasks, you can save time, reduce manual errors, and ensure accuracy in your real estate bookkeeping records.

3. Stay Organized with Categories and Tags: Real estate transactions involve various income sources, expenses, and assets. To maintain clarity and transparency, establish clear categories and tags for different types of transactions in your bookkeeping for the real estate business. Segment your income streams by property or tenant to track rental payments effectively. Categorize expenses based on their nature, such as maintenance, utilities, or property taxes. Utilize tags to identify transactions related to specific projects or investments. Organizing your financial data in this manner facilitates easier analysis, budgeting, and tax preparation.

4. Regular Reconciliation: Reconciliation is a crucial aspect of real estate bookkeeping that should not be overlooked. Regularly check your bank accounts, credit cards, and financial statements to make sure they correctly show your financial situation. This helps ensure that your records match your real finances. Address any differences promptly to maintain the integrity of your financial data. Reconciliation not only helps identify errors and fraud but also provides insights into cash flow patterns and spending trends. Make reconciliation a routine part of bookkeeping for the real estate business process to keep your financial records accurate and up to date.

5. Seek Professional Guidance: While managing bookkeeping for real estate businesses internally can save costs, seeking professional guidance can offer invaluable expertise and peace of mind. Consider hiring a certified public accountant (CPA) or a real estate-focused financial advisor to oversee your bookkeeping processes, provide strategic insights, and ensure compliance with tax regulations. A knowledgeable professional can offer tailored advice, identify opportunities for tax optimization, and help you manage complex financial scenarios. By utilizing external expertise, you can enhance the quality of your real estate bookkeeping practices and make informed financial decisions.

How does Meru Accounting Help in Bookkeeping for Real Estate Business?

Meru Accounting specializes in bookkeeping for the real estate business. Our range of services includes monthly bookkeeping, financial statements, payroll management, tax returns, accounts receivable/payable management, reconciliations, cash flow management, budgeting & forecasting, cost reduction, and cloud-based solutions. We have extensive knowledge of various accounting software and can cater to clients in different states across the USA.

Meru Accounting offers specialized services tailored to meet the unique needs of real estate bookkeeping. From monthly financial statements to payroll management and tax returns, we provide comprehensive solutions to streamline your operations. With our expertise in various accounting software and a focus on accuracy and efficiency, we ensure your financial records are in order, allowing you to focus on growing your real estate business.