Accounting software for real estate plays a crucial role in streamlining financial processes and ensuring accurate record-keeping. It simplifies tasks such as tracking expenses, managing rental payments, and monitoring cash flow. Automating these processes reduces human error and saves valuable time, allowing real estate professionals to focus on core business activities. Moreover, accounting software for real estate provides insights into financial performance, enabling informed decision-making for property investments and portfolio management. Ultimately, its importance lies in promoting efficiency, transparency, and compliance within the real estate sector, boosting growth and success for businesses in this dynamic industry.

Why Bookkeeping Software Matters in Real Estate

For managing the complexities of real estate transactions, precise financial management is crucial. Bookkeeping software serves as the backbone of this process, enabling professionals to organize, track, and analyze their financial data with precision and ease. From property acquisitions and rental income to expenses and tax obligations, comprehensive accounting software for real estate streamlines operations minimizes errors, and provides valuable insights for informed decision-making.

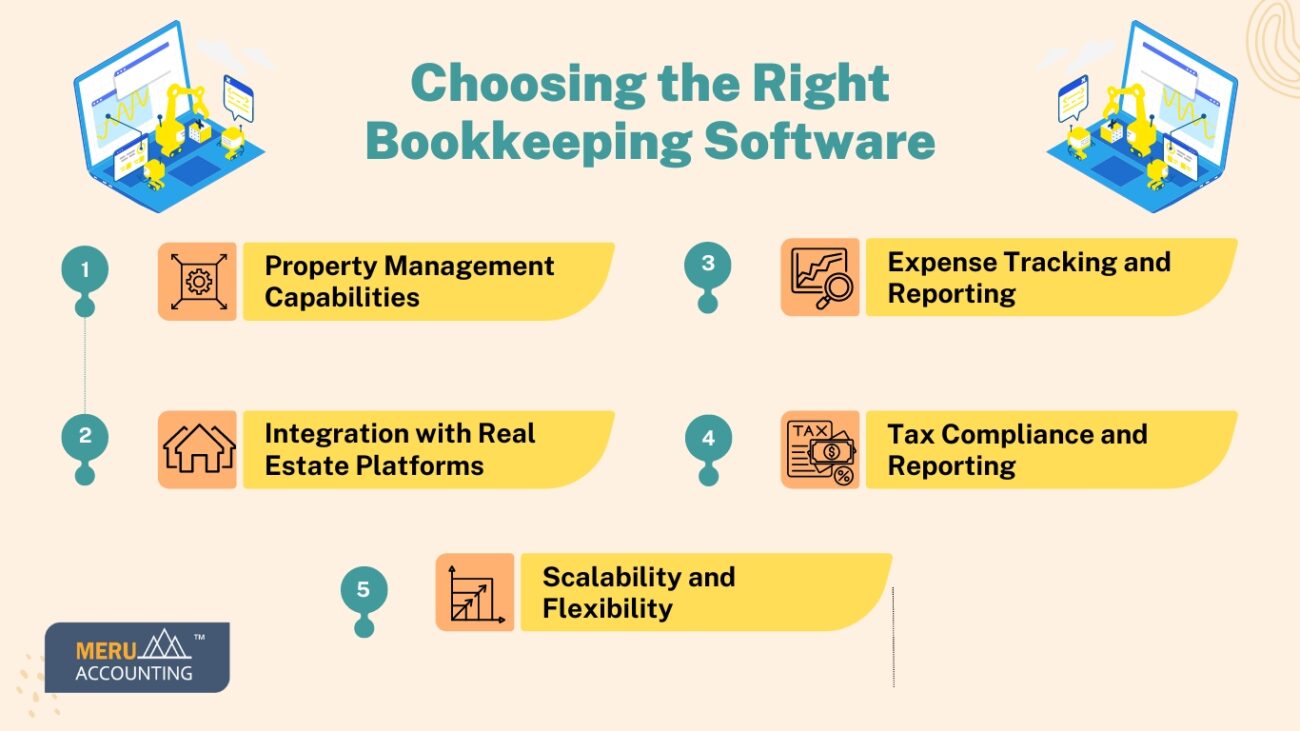

Choosing the Right Bookkeeping Software

When selecting bookkeeping software for real estate purposes, it’s essential to prioritize features that cater to the unique requirements of the industry.

1. Property Management Capabilities: Opt for software that allows you to manage multiple properties seamlessly. Look for features such as rent tracking, lease management, and expense allocation specific to each property.

2. Integration with Real Estate Platforms: Choose software that integrates seamlessly with popular real estate platforms such as Zillow, Realtor.com, or MLS listings. This integration facilitates data synchronization and eliminates the need for manual entry, saving time and reducing errors.

3. Expense Tracking and Reporting: Effective expense tracking is vital for real estate professionals to monitor cash flow and optimize profitability. Look for software that offers robust expense tracking features, customizable reporting templates, and insights into property-specific expenses.

4. Tax Compliance and Reporting: Ensure that the software simplifies tax compliance by generating accurate reports and facilitating deductions for property-related expenses. Look for features such as depreciation tracking and support for Schedule E tax reporting.

5. Scalability and Flexibility: As your real estate portfolio grows, your accounting needs will evolve. Choose software that is scalable and flexible, capable of accommodating your expanding business operations without compromising performance or efficiency.

Examples of Best Bookkeeping Software

At Meru Accounting, we specialize in providing outsourced bookkeeping and accounting services, utilizing a variety of top-notch software platforms. Some of the best bookkeeping software solutions are:

1. QuickBooks: Developed by Intuit, QuickBooks is one of the most popular accounting software programs for small and medium-sized businesses. It offers features for managing invoices, expenses, payroll, and more.

2. FreshBooks: FreshBooks is cloud-based accounting software primarily designed for small businesses and freelancers. It offers features such as invoicing, time tracking, expense tracking, and reporting.

3. NetSuite: NetSuite, owned by Oracle, is a cloud-based ERP system that integrates accounting, financial management, CRM, and e-commerce functionalities. It’s inclined towards medium-large businesses.

4. Wave: Wave is a free accounting software for small enterprises and freelancers. It includes features like invoicing, spending tracking, and financial reporting.

5. Odoo: Odoo is an open-source ERP system that provides a suite of business applications, including accounting, CRM, inventory management, and more. It’s highly customizable and scalable.

6. Sage: Sage offers a range of accounting and ERP solutions tailored for businesses of all sizes, from small businesses to large enterprises. Its offerings include accounting software, payroll solutions, and enterprise resource planning systems.

7. MYOB: MYOB (Mind Your Own Business) is an accounting software primarily used in Australia and New Zealand. It offers features for invoicing, expense tracking, payroll, and inventory management.

Whether you’re a freelancer, a small business owner, or a large enterprise, these bookkeeping software solutions offer the tools and features necessary to keep your financial matters in order, ensuring a smooth journey of business success.