From small startups to large corporations, the smooth flow of incoming payments is crucial for sustaining operations, growth, and profitability. However, the complexities of accounts receivable management can often overwhelm even the most adept business owners. This is where outsourcing accounts receivable can help.

Timely collection of these outstanding payments ensures a healthy cash flow, enabling businesses to meet their financial obligations, invest in growth initiatives, and seize new opportunities. On the other hand, inefficient accounts receivable management can lead to cash flow bottlenecks, increased debt, and hampered growth prospects.

Outsourcing accounts receivable involves handing over the management of invoicing, billing, collections, and reconciliation processes to specialized third-party service providers. This approach allows businesses to leverage the expertise, technology, and resources of outsourcing partners, thereby streamlining operations and enhancing financial performance.

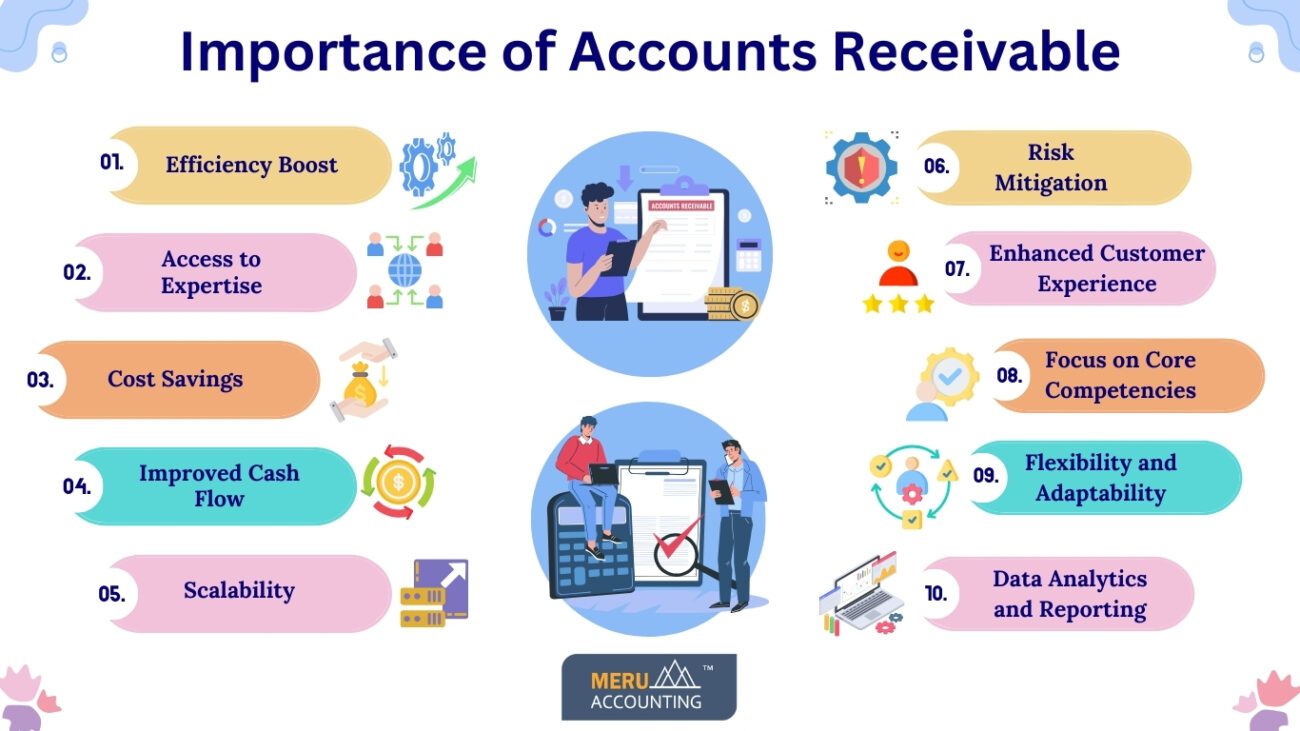

Importance of Accounts Receivable

Accounts receivable (AR) represents the money a company expects to receive shortly, typically within a short time frame, usually ranging from a few days to a few months.

The importance of accounts receivable lies in its contribution to a company’s cash flow and overall financial health. Additionally, accounts receivable often represent a significant portion of a company’s assets and can impact its liquidity ratios and economic performance.

Here’s how outsourcing accounts receivable can elevate your business:

- Efficiency Boost: Outsourcing accounts receivable can significantly improve efficiency by allowing businesses to focus on core operations while experts handle invoicing, collections, and reconciliations.

- Access to Expertise: Outsourcing provides access to specialized skills and knowledge in accounts receivable management, including compliance with regulations, industry best practices, and technology tools.

- Cost Savings: By outsourcing, companies can reduce costs associated with hiring and training internal staff, maintaining software systems, and managing overhead expenses related to accounts receivable functions.

- Improved Cash Flow: Outsourcing can lead to faster collections and reduced days of sales outstanding (DSO), improving cash flow and providing better-working capital management.

- Scalability: Outsourcing allows businesses to scale their accounts receivable operations according to fluctuations in demand or business growth without the hassle of hiring and firing employees.

- Risk Mitigation: Outsourcing partners often have systems in place to minimize credit risk, fraud, and errors, providing a layer of protection for businesses against financial losses.

- Enhanced Customer Experience: Outsourcing accounts receivable can lead to better customer interactions, as dedicated professionals handle billing inquiries, resolve disputes promptly, and maintain positive relationships with clients.

- Focus on Core Competencies: With accounts receivable tasks outsourced, companies can focus more on their core competencies, strategic planning, and business development initiatives, leading to overall growth and competitiveness.

- Flexibility and Adaptability: Outsourcing providers can quickly adapt to changes in regulations, market conditions, or technological advancements, ensuring that accounts receivable processes remain efficient and compliant.

- Data Analytics and Reporting: Outsourcing partners often offer advanced analytics and reporting capabilities, providing valuable insights into financial performance, trends, and areas for improvement within accounts receivable management.

With the power of outsourcing accounts receivable, businesses can streamline operations, reduce costs, improve cash flow, and ultimately drive growth and success.

Conclusion

We explored several benefits that outsourcing accounts receivable (AR) management can bring to businesses. From improved cash flow and reduced bad debt to enhanced efficiency and scalability, outsourcing AR functions can significantly contribute to the financial health and operational effectiveness of an organization. Meru Accounting offers comprehensive AR management services. Outsource your AR management to us and focus on the other aspects of your business.