Precise bookkeeping is essential for managing investments in the real estate sector. Effective real estate bookkeeping practices ensure financial accuracy, and adherence to regulations, significantly contributing to business growth and investment success. Investing in real estate demands precise financial management for assured success.

Proper bookkeeping helps investors monitor their income and expenses and supports strategic decision-making and compliance with legal standards. Bookkeeping for real estate businesses allows for better financial forecasting and risk management, making it a foundation of a flourishing real estate investment strategy. These practices are fundamental to maintaining financial health and ensuring the sustainability of the business in a competitive market.

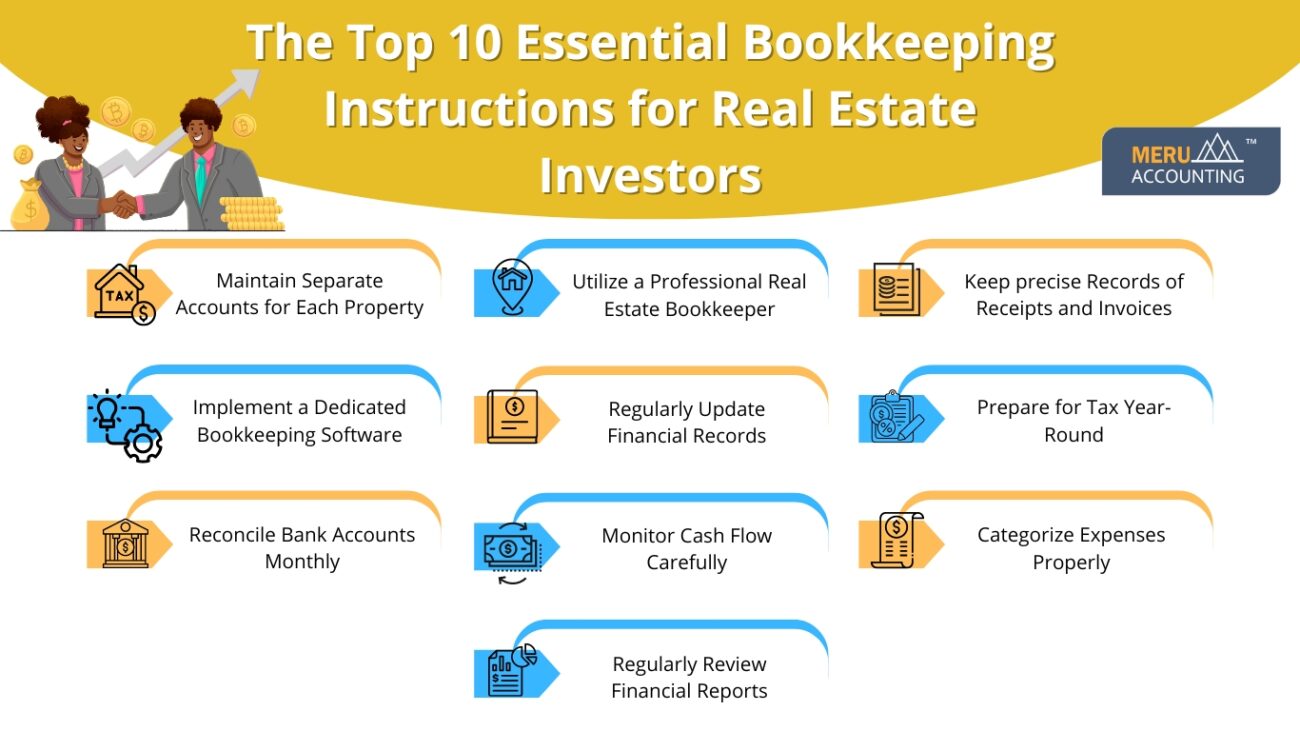

The Top 10 Essential Bookkeeping Instructions for Real Estate Investors

Maintain Separate Accounts for Each Property

For clarity in tracking income and expenses, it’s essential to have separate bank accounts for each property. This separation simplifies understanding the financial performance of individual investments and helps in more precise reporting.

Implement a Dedicated Bookkeeping Software

Modern real estate bookkeeping services rely heavily on robust software solutions. These tools are designed to handle complex calculations, generate detailed financial reports, and store data securely. Investing in specialized bookkeeping software is crucial for efficient management and data accuracy.

Regularly Update Financial Records

Consistency in updating your books can prevent a multitude of problems. Regular updates ensure that your financial data is always current, providing accurate insights for making informed decisions. This practice also simplifies year-end reconciliations and tax preparations.

Monitor Cash Flow Carefully

Cash flow is the lifeblood of any real estate business. Keeping a close watch on your cash flow helps in understanding the liquidity position of your business and in planning for future expenses or investments effectively.

Categorize Expenses Properly

Accurately categorizing expenses not only aid in detailed financial reporting but also in maximizing tax deductions. Common categories include repairs, capital improvements, management fees, and property taxes, among others.

Utilize a Professional Real Estate Bookkeeper

Even if you possess some accounting knowledge, employing a professional specializing in bookkeeping for real estate business can add significant value. These experts ensure compliance with the latest tax laws and financial practices specific to the real estate sector.

Keep precise Records of Receipts and Invoices

Documenting every financial transaction with receipts and invoices is crucial. These documents are indispensable for audits and tax filings, and they serve as proof of your reported expenses and income.

Prepare for Tax Year-Round

Don’t wait for tax season to start preparing. Effective real estate bookkeeping services include ongoing tax preparation strategies, such as estimating tax liabilities and setting aside funds to meet these obligations.

Reconcile Bank Accounts Monthly

Reconciling your bank accounts with your financial records every month helps in catching and correcting any discrepancies early. This not only keeps your finances in order but also guards against fraud and mismanagement.

Regularly Review Financial Reports

Generating and reviewing financial reports (like profit and loss statements, balance sheets, and cash flow statements) should be a routine part of your bookkeeping. These reports provide vital information on the financial health of your business and are essential for strategic planning and decision-making.

Conclusion

Effective bookkeeping is crucial for the success of any real estate investment venture. By implementing these ten bookkeeping guidelines, you can establish a solid financial foundation for your real estate business. Managing financial records can be challenging, but the clarity it provides is essential for your business’s health. For optimal results, we recommend utilizing professional real estate bookkeeping services. At Meru Accounting, we specialize in bookkeeping for real estate businesses, ensuring that your financial operations are carefully organized and your investment outcomes are maximized. Contact us now for exceptional real estate bookkeeping services that can maximize profitability in your business.