In the fast-paced world of real estate investing, every dollar matters. Whether you’re a seasoned investor or new to the market, learning the art of accounting for real estate and bookkeeping for real estate is critical to optimizing earnings. The ability to efficiently handle funds can be the difference between thriving and just surviving. Among the range of options accessible to investors, one fundamental factor that is sometimes forgotten is effective bookkeeping. Integrating rigorous accounting standards into your real estate business may greatly increase profitability and streamline operations.

Understanding Accounting for Real Estate

Accounting for real estate encompasses a diverse range of financial activities customized specifically to the unique complexities of property investment. From tracking rental income and expenses to managing property taxes and depreciation, Accounting for real estate demands precision and foresight. By carefully recording every financial transaction, investors gain invaluable insights into their property portfolios, enabling informed decision-making and proactive risk management.

The Strategic Role of Bookkeeping for Real Estate

Bookkeeping for real estate serves as the cornerstone of effective financial management in real estate. By maintaining accurate records of income and expenses, investors can assess the profitability of individual properties, identify areas for improvement, and optimize their investment strategies. Moreover, comprehensive bookkeeping for real estate facilitates compliance with regulatory requirements and ensures transparency in financial reporting, bolstering investor confidence and mitigating legal risks.

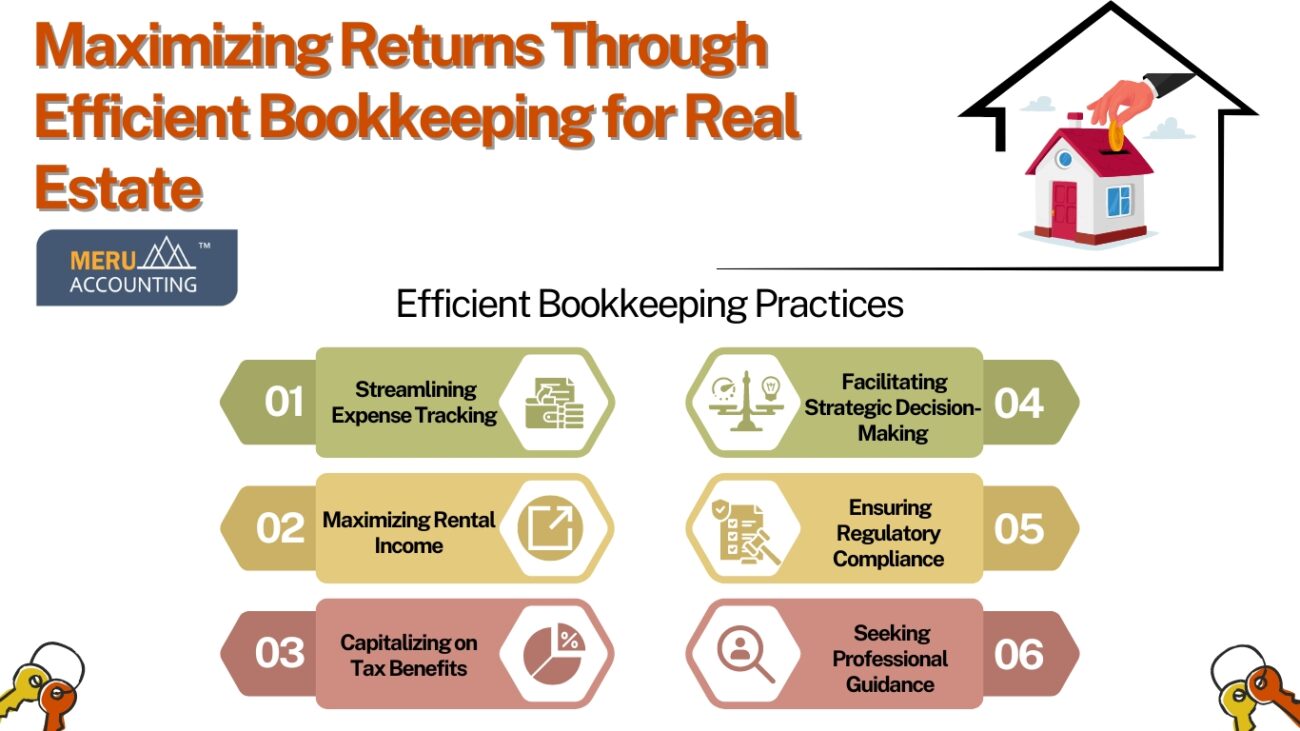

Efficient Bookkeeping Practices

1. Streamlining Expense Tracking: Implementing robust bookkeeping systems enables investors to precisely track all expenses associated with their properties, from maintenance and repairs to utilities and insurance premiums. By categorizing expenses and analyzing spending patterns, investors can identify opportunities for cost savings and allocate resources more efficiently.

2. Maximizing Rental Income: Effective bookkeeping empowers investors to monitor rental income closely and promptly identify any discrepancies or late payments. By maintaining rigorous rent collection procedures and promptly addressing delinquencies, investors can optimize cash flow and minimize income disruptions, thereby maximizing overall returns on investment.

3. Capitalizing on Tax Benefits: Accurate bookkeeping lays the groundwork for maximizing tax deductions and using available incentives in real estate investment. By precisely documenting deductible expenses such as mortgage interest, property taxes, and depreciation, investors can minimize their tax liabilities and enhance after-tax returns, thereby increasing overall profitability.

4. Facilitating Strategic Decision-Making: Informed by comprehensive financial data, investors can make strategic decisions regarding property acquisition, disposition, and portfolio diversification. By analyzing key performance indicators such as return on investment (ROI) and cash-on-cash return, investors can identify underperforming assets, capitalize on emerging opportunities, and optimize their investment portfolios for long-term success.

5. Ensuring Regulatory Compliance: Adherence to accounting standards and compliance requirements is paramount. By maintaining precise records and staying updated with relevant regulations, investors can avoid costly penalties and legal disputes, safeguarding their financial interests and preserving long-term sustainability.

6. Seeking Professional Guidance: While managing your bookkeeping can be feasible, engaging the services of a qualified accountant or financial advisor specializing in real estate can provide invaluable expertise. They can offer strategic guidance, ensure compliance with tax laws, and help identify opportunities for maximizing returns. Additionally, outsourcing bookkeeping tasks frees up your time to focus on other aspects of your real estate business.

How Meru Accounting can help you?

Meru Accounting provides tax planning, record-keeping, depreciation, tax credits & deductions, income recognition, and expense acceleration services to real estate professionals. Our comprehensive bookkeeping services, financial reporting, and risk management support help optimize financial strategies, leading to maximized returns in the real estate industry.

Conclusion

In the world of real estate investment, accurate bookkeeping is critical for increasing profits and maintaining development. Investors may make educated judgments and successfully handle regulatory complexities by carefully managing expenses, optimizing rental revenue, and utilizing tax benefits. Working with specialists like Meru Accounting enables efficient financial administration, which unlocks the full value of real estate assets.