Maintaining accurate and efficient financial records can significantly influence your business’s success. As we enter 2024, real estate investors increasingly recognize the importance of robust bookkeeping practices. Effective bookkeeping for real estate investors is crucial for tracking the performance of investments, optimizing cash flow, and strategizing for tax liabilities.

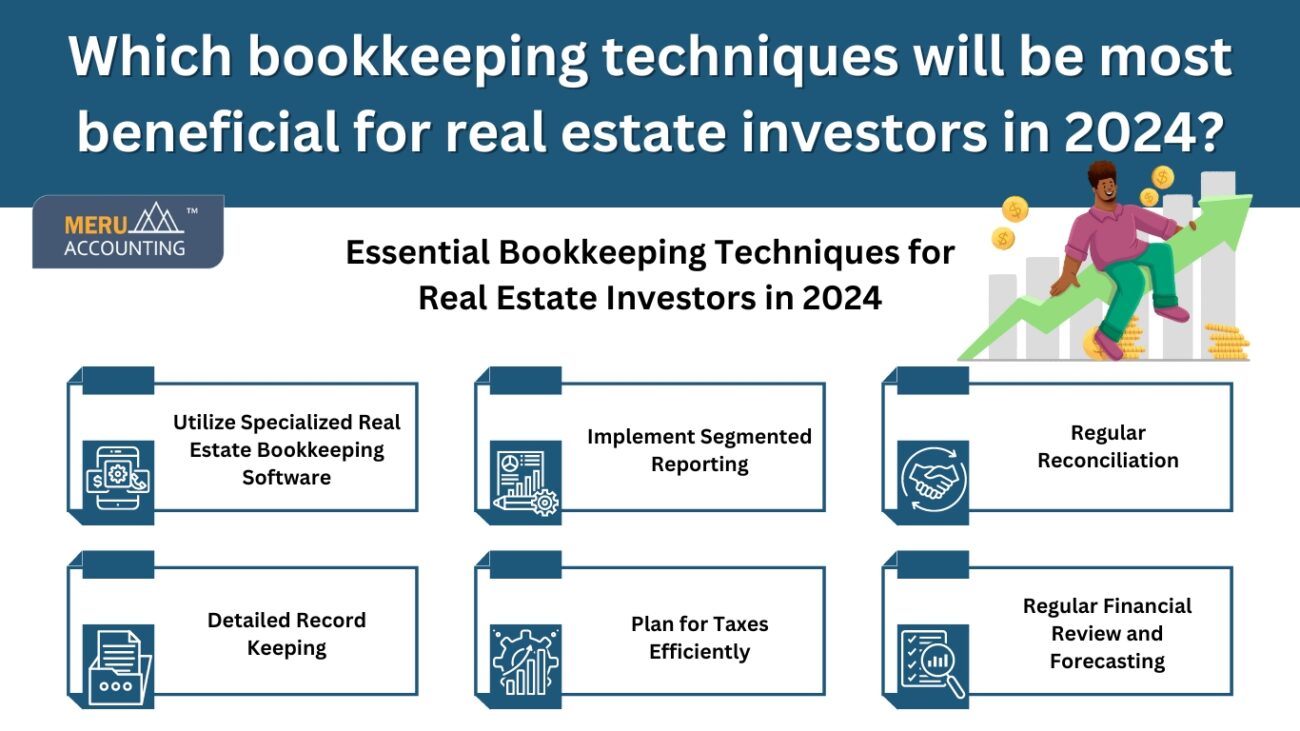

Essential Bookkeeping Techniques for Real Estate Investors in 2024

Utilize Specialized Real Estate Bookkeeping Software:

The first technique every real estate investor should consider is the adoption of specialized real estate bookkeeping software. These platforms are designed to handle the unique challenges of the real estate industry, such as managing rental income, operating expenses, and depreciation. Software like QuickBooks, Xero, or industry-specific tools like Buildium or AppFolio can automate much of the routine data entry and generate real-time financial reports. This not only improves precision but also conserves crucial time.

Regular Reconciliation:

Reconciling your accounts regularly is essential to maintaining the integrity of your financial records. This means ensuring that your bank transactions match the entries in your bookkeeping software for real estate bookkeeping. Regular reconciliation helps in catching discrepancies early, be it from bank errors, missed entries, or unauthorized transactions. A monthly review is recommended to keep everything on track and transparent.

Detailed Record Keeping:

For bookkeeping for real estate investors, maintaining detailed records is crucial. This involves not just tracking receipts and invoices but also maintaining complete records of leases, tenant payments, maintenance costs, property management fees, and capital improvements. Detailed records support not only financial analysis and budgeting but are also essential for audits and securing financing.

Implement Segmented Reporting:

Segmented reporting is a technique where financial information is divided into key areas or segments – for instance, by property, by unit, or by type of revenue. This approach allows investors to analyze the profitability and cash flow of each segment independently, providing insights that drive better-informed investment decisions. In real estate bookkeeping, this can mean distinguishing between residential and commercial properties, or rental income versus service income, to create strategies specific to each segment.

Plan for Taxes Efficiently:

Tax planning is an integral part of bookkeeping for real estate investors. Efficient tax planning involves strategies to defer, reduce, or avoid taxes through legal means. Real estate investors should work closely with a tax advisor to make the most of depreciation, mortgage interest deductions, and other real estate-specific opportunities. Effective bookkeeping ensures all necessary documentation is to claim these benefits.

Regular Financial Review and Forecasting:

Regular financial reviews and forecasting are essential bookkeeping practices. They involve analyzing financial statements to assess your investment’s performance and project future cash flows and profitability. This forward-looking approach helps in adjusting strategies in response to market changes or financial performance, thereby optimizing investment returns.

These top bookkeeping techniques can be most beneficial for real estate investors in 2024. At Meru Accounting, we understand that effective bookkeeping for real estate investors in 2024 revolves around selecting the right tools, keeping detailed records, and employing savvy financial strategies.

By integrating these practices, real estate investors working with us can gain a precise understanding of their financial status, ensure compliance with regulatory standards, and set the stage for future growth in a dynamic real estate market. By prioritizing top-level bookkeeping for real estate investors, we help you maintain the financial health and scalability of your real estate ventures.