Strategic tax planning lies at the core of attaining the success of any small business, which depends heavily on effective financial management. Tax planning services for small businesses aim to maximize profitability and ensure sustainable growth and compliance. Knowing how to take advantage of tax planning can greatly impact your revenue.

The Significance of Tax Planning for the Success of Small Businesses

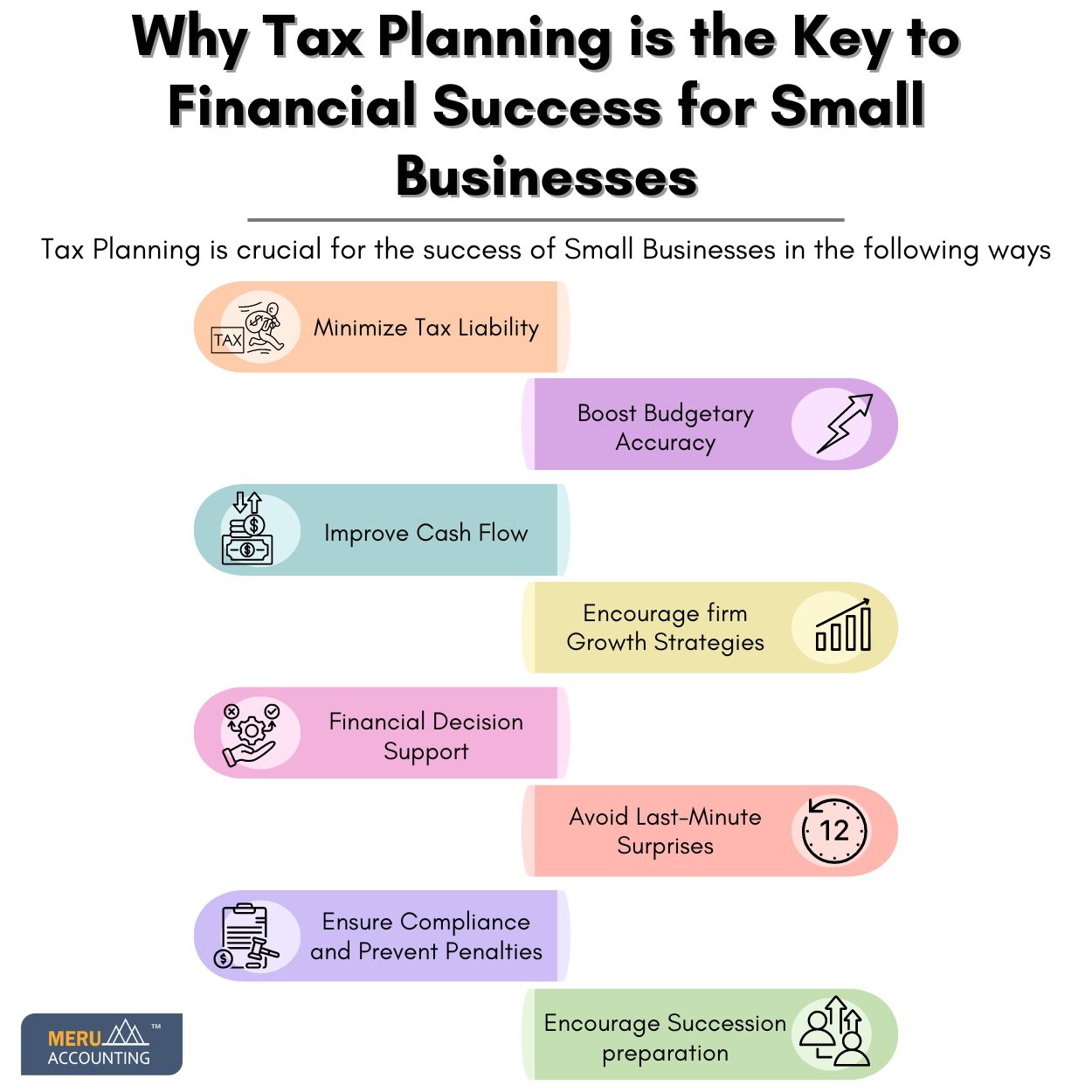

Any small firm should include tax planning as a core component of its financial strategy. Tax planning services for small businesses are crucial for achieving success. Here is why tax planning is vital:

Minimize Tax Liability:

Small firms can reduce their tax liabilities by using effective tax planning. It is possible to drastically reduce the amount of taxes due by taking advantage of allowable tax deductions, credits, and incentives.

Improve Cash Flow:

By managing when and how much tax is paid, tax planning can improve a business’s cash flow. Better cash flow management ensures that funds are available for critical business operations and investments.

Financial Decision Support:

Important financial information from tax planning can have an impact on business choices. Business owners may make more educated decisions about investments, expansions, and other large financial commitments when they are aware of the possible tax ramifications.

Ensure Compliance and Prevent Penalties:

Keeping up with tax regulations and avoiding expensive penalties and audits are achieved by providing tax planning services for small businesses.

Boost Budgetary Accuracy:

Because tax planning lays out anticipated tax obligations in detail, it facilitates more precise budget forecasting. Businesses can prepare their annual budget more skillfully thanks to this financial planning predictability.

Encourage firm Growth Strategies:

By determining the most tax-effective means to carry out expansion plans, such as through reinvestment, alterations to the firm structure, or investigation of new opportunities, strategic tax planning can encourage business growth.

Avoid Last-Minute Surprises:

Small businesses can steer clear of the unpleasant surprises that accompany the discovery of substantial, unforeseen tax liabilities by engaging in regular tax planning. Frequent planning guarantees that taxes are foreseen and carefully handled all year long.

Encourage Succession preparation:

Tax preparation is an essential tax planning service for small businesses that intend to hand over their operations to the upcoming generation. A more seamless transition can be achieved by using effective techniques that reduce future tax liabilities.

Conclusion

Meru Accounting provides customized tax planning services for small businesses that are based on the particular requirements and objectives of each company. Our experts offer thorough advice, covering everything from finding ways to save taxes to making sure you’re abiding by the most recent tax regulations. Small businesses can use Meru Accounting’s resources to turn their tax planning techniques into effective engines of growth and stability in their finances.

Summary

Why Tax Planning Services is Key to Financial Success for Small Businesses

Tax Planning is crucial for the success of Small Businesses in the following ways

- Minimise Tax Liability

- Improve Cash Flow

- Financial Decision Support

- Ensure Compliance and Prevent Penalties

- Boost Budgetary Accuracy

- Encourage firm Growth Strategies

- Avoid Last-Minute Surprises

- Encourage Succession preparation