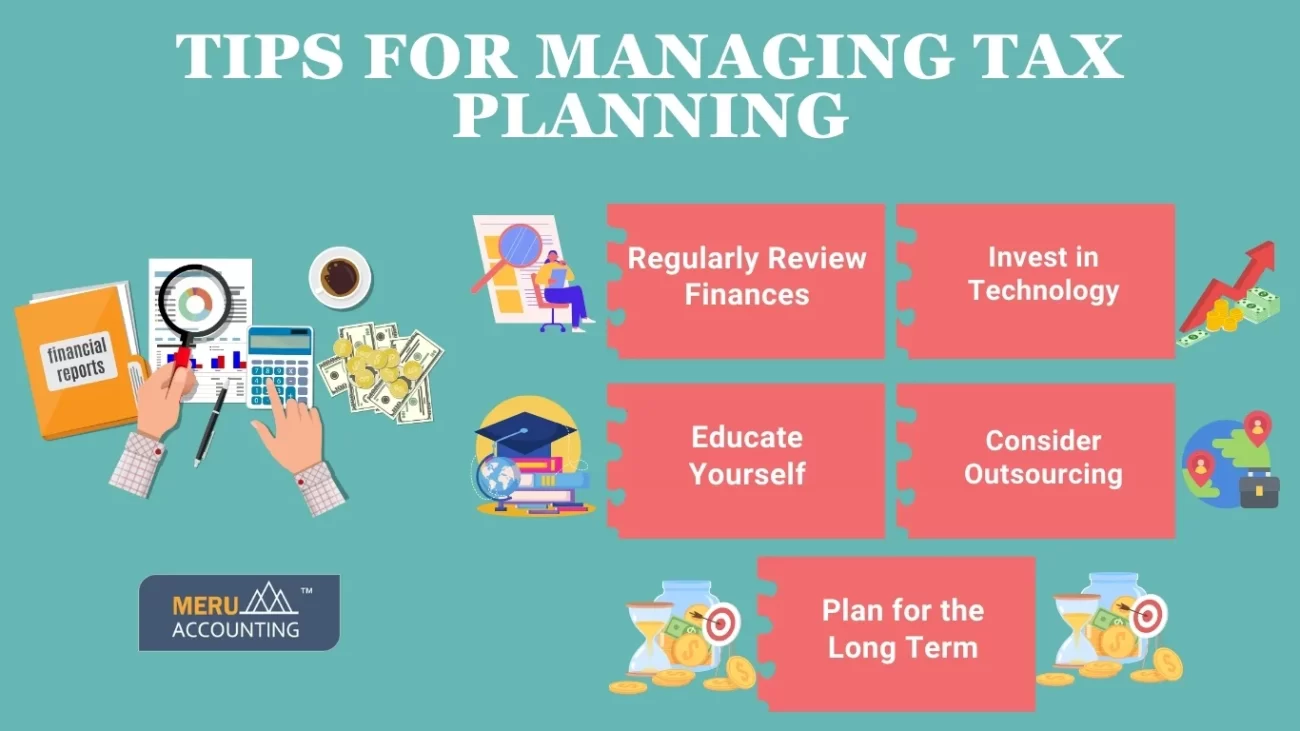

How Can Small Businesses Implement Effective Tax Planning Strategies? Implementing effective tax planning strategies is essential for small businesses looking to maximize their savings and streamline their tax obligations....

2024 Tax Brackets: Are You Due for a Raise (or Tax Hike)? The tax landscape for 2024 is shifting, and many taxpayers may find themselves impacted by changes in...

Effective tax planning is crucial for small business owners seeking to optimize their financial performance and minimize liabilities. Utilizing comprehensive tax planning services for small businesses can make a...

Tax planning is not just a seasonal task; it’s a year-round strategy that can significantly impact the financial health of your small business. With expert tax planning services for...

Running a small business comes with its fair share of challenges, and managing taxes is undoubtedly one of them. However, with the right approach, tax planning can become a...

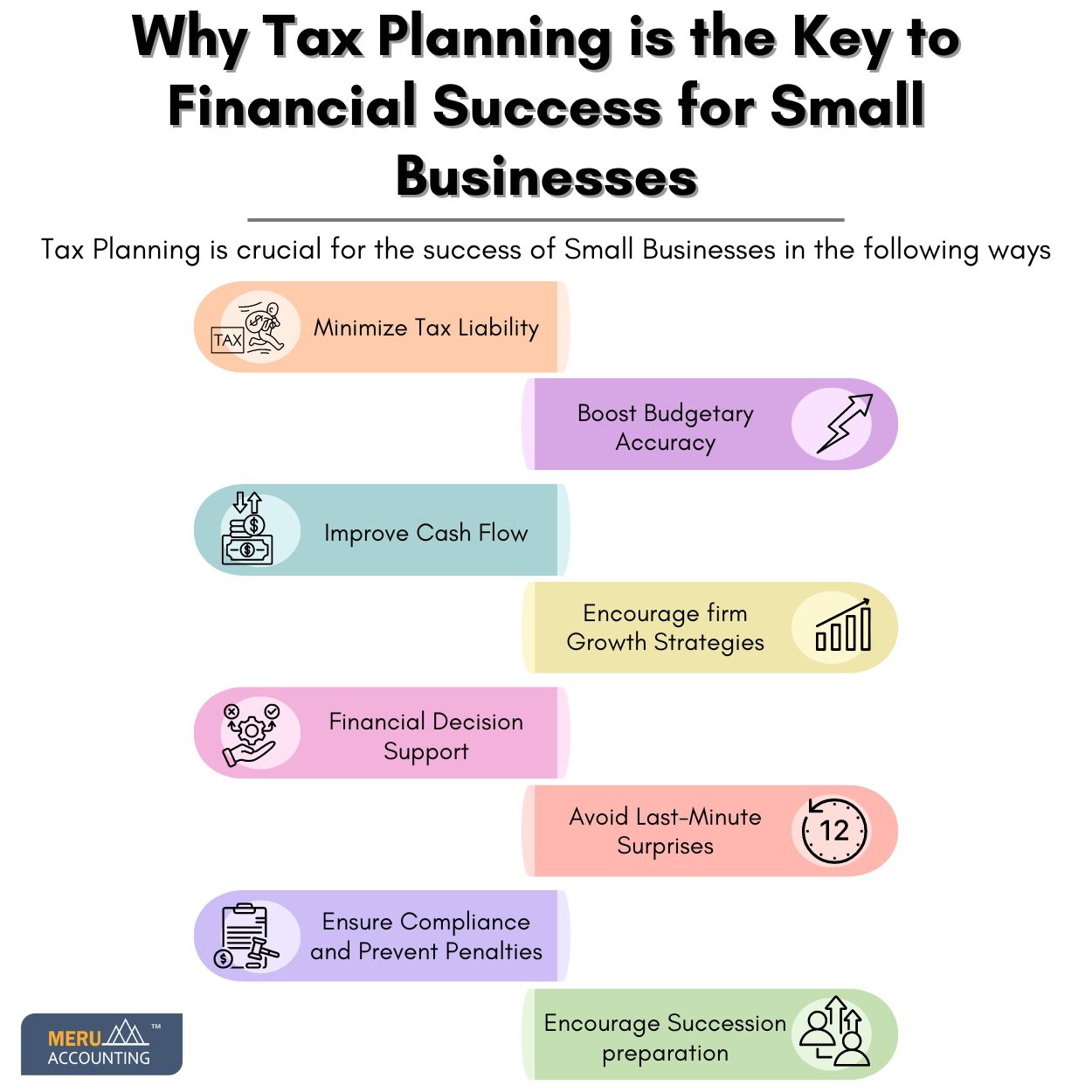

Strategic tax planning lies at the core of attaining the success of any small business, which depends heavily on effective financial management. Tax planning services for small businesses aim...

Tax planning is a crucial aspect of managing a small business efficiently. It involves making strategic decisions to minimize tax liabilities and maximize deductions within the legal framework. Small...

Tax Planning Services for Small Businesses are essential in the USA to ensure their success. Though it might seem challenging, using effective tax planning strategies can greatly ease the...