Precise bookkeeping plays an important role in the real estate business. Whether you’re a seasoned investor, property manager, or real estate agent, keeping accurate financial records is crucial for success. From tracking expenses to managing rental income, effective bookkeeping ensures you’re always in control of your finances.

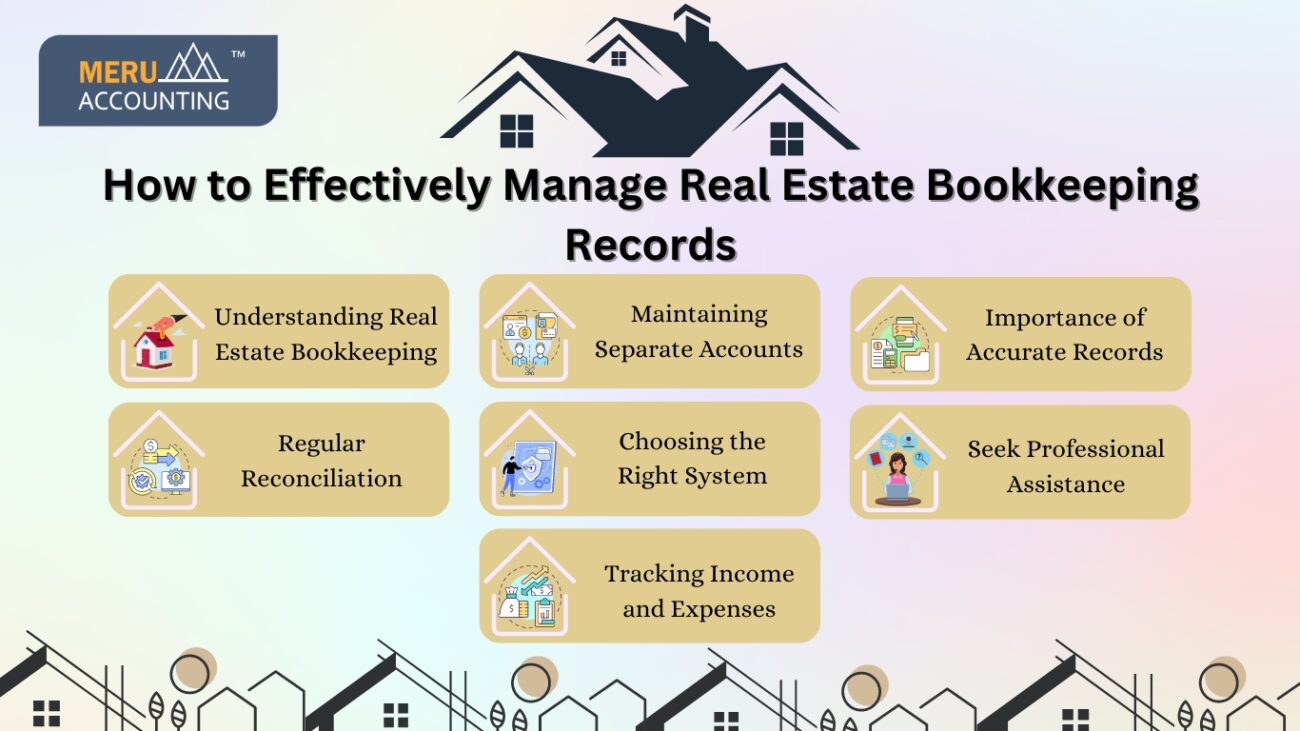

Understanding Real Estate Bookkeeping

Real estate bookkeeping services involve keeping a detailed record of all financial transactions related to your real estate business. This covers everything from buying and selling properties to tracking rental income, expenses, and taxes. Effective bookkeeping gives you a clear understanding of your financial situation, helping you make informed decisions and stay compliant with regulations. It’s essential for managing your real estate business efficiently and effectively.

Importance of accurate records

- Accurate bookkeeping is crucial to a successful real estate enterprise.

- It helps in monitoring cash flow and conducting a thorough profitability analysis.

- Precise records enable the identification of areas needing improvement.

- It simplifies tax preparation and ensures optimal use of deductions.

- Active bookkeeping is essential for optimizing returns and reducing risks.

- Specialized services tailored to real estate needs provide comprehensive support for efficient operations and financial prudence.

Choosing the Right System

Selecting the right system for managing finances in real estate is crucial. While some still opt for traditional methods like pen and paper, modern technology provides numerous software solutions tailored for real estate professionals. It’s important to look for specialized bookkeeping services or software designed specifically for the real estate industry, such as QuickBooks Online, Buildium, or AppFolio. These platforms offer various features like tracking expenses, collecting rent, and generating financial reports, which streamline the bookkeeping process and save valuable time for businesses involved in real estate.

Tracking Income and Expenses

Effective real estate bookkeeping services involve careful tracking of income and expenses related to properties. This includes rent received, maintenance expenses, utilities, mortgage payments, property taxes, insurance premiums, and other relevant costs. Accurate categorization of transactions is crucial for streamlined reporting and analysis. Many bookkeeping for real estate business platforms offer customizable categories to meet individual requirements. It’s essential to maintain professionalism and clarity in managing financial records for real estate ventures.

Maintaining Separate Accounts

For efficient bookkeeping and clear financial records in your real estate business, it’s recommended to keep personal and business finances separate. Establish dedicated bank accounts and credit cards specifically for your real estate activities. This practice makes it simpler to monitor income and expenses. Additionally, separating finances facilitates tax preparation and ensures adherence to accounting standards, enhancing the overall management of your real estate bookkeeping services.

Regular Reconciliation

Regular reconciliation is crucial for maintaining the precision of your financial records in bookkeeping for real estate business. This process entails cross-referencing your bookkeeping records with bank statements and other financial documents to pinpoint any inconsistencies. Conducting monthly reconciliations allows you to detect errors promptly and mitigate the risk of them escalating into larger problems later on.

Seek Professional Assistance

Managing your bookkeeping might seem cost-effective, but opting for professional bookkeeping services tailored for real estate businesses can offer significant advantages. These specialized bookkeepers are adept at handling intricate transactions, navigating tax laws, and offering valuable financial insights. Outsourcing bookkeeping for real estate businesses not only frees up your time to concentrate on business growth but also ensures precision and compliance with financial records.

Conclusion

Ensuring proficient real estate bookkeeping is essential for achieving success in the field. By recognizing the significance of precise documentation, selecting suitable systems, conscientiously monitoring income and expenditures, upholding separate accounts, routinely reconciling accounts, and seeking expert guidance when necessary, you can optimize your bookkeeping procedures and effectively manage your real estate business with Meru Accounting.