How Can Small Businesses Implement Effective Tax Planning Strategies?

Implementing effective tax planning strategies is essential for small businesses looking to maximize their savings and streamline their tax obligations. Tax planning involves making strategic financial decisions throughout the year to reduce tax liabilities, improve cash flow, and support long-term business growth. By integrating tax planning services for small businesses, owners can navigate complex tax laws more effectively and uncover various opportunities for deductions, credits, and other tax-saving strategies.

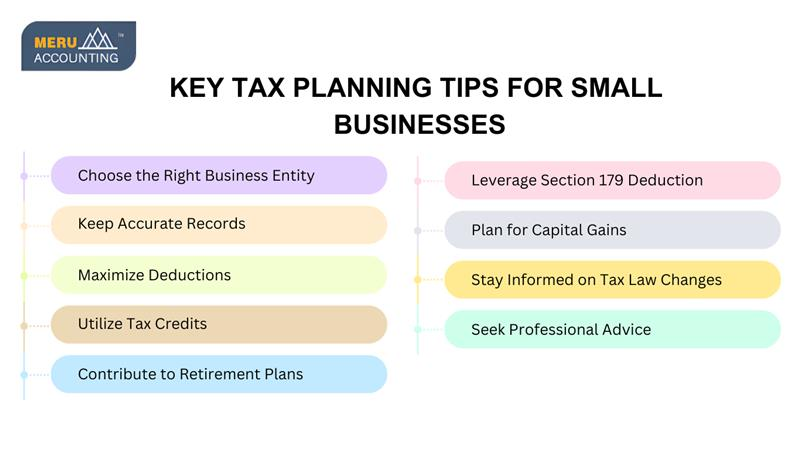

Essential Tax Planning Strategies for Small Businesses

- Choose the Right Business Entity: Whether you’re a sole proprietor, a partnership, an LLC, or a corporation, each structure has different tax implications. For example, corporations may benefit from tax breaks that sole proprietorships do not. Consulting with a tax professional can help you select the best entity to align with your business goals and tax planning needs.

- Keep Accurate Records: Good tax planning starts with accurate record-keeping. Keep detailed records of income, expenses, receipts, and invoices. This not only makes it easier to identify tax deductions and credits but also ensures compliance with tax regulations. By organizing your records, you set a solid foundation for maximizing tax savings and avoiding potential tax issues.

- Maximize Deductions: Taking advantage of available deductions is essential for effective tax planning. Deductible expenses can include home office costs, business travel, and equipment purchases. Properly categorizing these expenses helps reduce taxable income, resulting in lower taxes. A tax professional can help you identify deductions relevant to your business, so you don’t miss out on potential savings.

- Utilize Tax Credits: Tax credits directly reduce your tax liability, often dollar-for-dollar. For small businesses, some helpful credits include the Small Business Health Care Tax Credit and the Work Opportunity Tax Credit. Exploring which credits your business qualifies for can be a great tax planning strategy, as it leads to immediate tax savings.

- Contribute to Retirement Plans: Setting up a retirement plan like a SEP IRA or Solo 401(k) can bring substantial tax benefits. Contributions to these plans are often tax-deductible, which can lower your taxable income. This strategy not only supports your financial future but also improves your business’s financial health through efficient tax planning.

- Leverage Section 179 Deduction: The Section 179 deduction allows businesses to deduct the cost of qualifying equipment and software purchases in the year they are acquired. Rather than spreading deductions over multiple years, Section 179 lets you take the full deduction upfront, helping you save on taxes while investing in your business.

- Plan for Capital Gains: If you’re planning to sell any business assets, it’s essential to understand the tax implications of capital gains. By timing your sales or structuring them strategically, you can minimize the impact of capital gains taxes. Proper planning helps reduce unexpected tax costs and maximizes your returns from asset sales.

- Stay Informed on Tax Law Changes: Tax laws are constantly changing, and staying informed is a key part of tax planning. New tax credits, deductions, or regulations may benefit your business, but only if you’re aware of them. Keeping up-to-date helps you adjust your strategies as needed to ensure compliance and optimize tax savings.

- Seek Professional Advice: Working with a tax professional or accountant is one of the best tax planning strategies for small businesses. They can provide personalized advice tailored to your specific situation, helping you make informed decisions to maximize tax benefits. Professional guidance ensures that your tax planning is thorough and meets all legal requirements.

Conclusion

Implementing these tax planning strategies can significantly benefit small businesses, helping them reduce tax burdens and enhance financial health. For professional support in navigating tax planning and tax planning services for small businesses, consider working with experts like Meru Accounting. At Meru Accounting, our tailored tax planning services for small businesses ensure that you take advantage of all available tax-saving opportunities.