Tax planning is a crucial aspect of managing a small business efficiently. It involves making strategic decisions to minimize tax liabilities and maximize deductions within the legal framework. Small business owners need to understand the importance of tax planning services for small businesses to ensure financial stability and growth.

Implementing effective tax planning services for small businesses can help businesses optimize their financial resources and navigate the complex tax landscape. By incorporating Tax Planning Services for Small Businesses into their overall strategy, entrepreneurs can proactively manage their tax obligations and capitalize on available opportunities, ultimately contributing to the success and sustainability of their ventures.

Tax Planning and Importance of Tax Planning

Tax planning involves structuring financial matters strategically to reduce tax obligations. Small business owners engage in tax planning to optimize their financial resources, comply with tax laws, and take advantage of available deductions and credits. Effective tax planning ensures that businesses can reinvest more of their earnings into growth and development.

Common Tax Planning Mistakes to Avoid

Despite its importance, many small businesses make common tax planning mistakes that can lead to increased tax liabilities. Some of these mistakes include inadequate record-keeping, overlooking eligible deductions, and failing to adopt legal business structures. The owners of small businesses need to be aware of these issues and take proactive measures to avoid them.

Key Strategies for Maximizing Deductions and Credits

1. Keeping Accurate Records

One of the fundamental aspects of successful tax planning is keeping accurate records. Maintaining well-organized financial records helps small business owners track income, expenses, and eligible deductions. This ensures that you can claim all applicable deductions, reducing your taxable income.

2. Utilizing Legal Business Structures

Choosing the right legal business structure is another key strategy in tax planning. Different structures, such as a sole proprietorship, partnership, corporation, or Limited Liability Company (LLC), have varying tax implications. Consulting with a tax professional to determine the most tax-efficient structure for your business can result in significant savings.

3. Taking Advantage of Tax Breaks and Incentives

Small businesses may qualify for various tax breaks and incentives provided by the government to stimulate economic growth. Researching and understanding these incentives, such as research and development credits or energy-efficient equipment deductions, can help businesses reduce their tax burden.

Meeting Tax Deadlines and Avoiding Penalties

Timely filing and payment of taxes are very important to avoid any kind of penalty or interest. Small business owners should be aware of tax deadlines and take proactive measures to meet them. This involves planning, organizing financial documents, and utilizing accounting software to streamline the tax preparation process.

The Role of a Professional Tax Advisor

Engaging the services of a professional tax advisor is a smart investment for small businesses. A tax advisor can provide personalized advice, identify potential tax-saving opportunities, and ensure compliance with ever-changing tax laws. Their expertise can help navigate complex tax regulations, ultimately optimizing your business’s financial position.

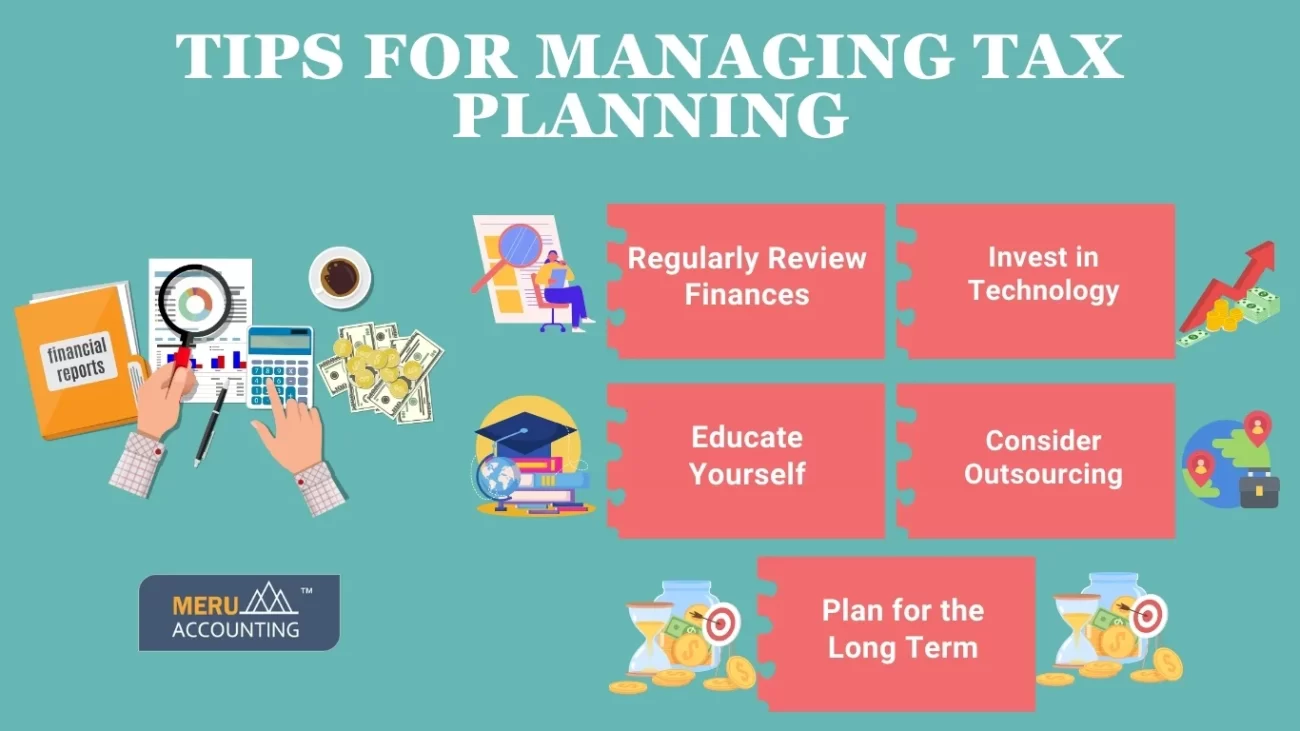

Tips for Managing Tax Planning

- Regularly Review Finances: Conduct periodic reviews of your financial statements to identify areas for potential tax savings.

- Invest in technology: Utilize accounting software and digital tools to automate record-keeping and ensure accuracy.

- Educate yourself: Stay informed about changes in tax laws and regulations to adapt your tax planning strategies accordingly.

- Consider Outsourcing: Outsourcing tax-related tasks to professionals allows you to focus on core business activities while ensuring compliance.

- Plan for the Long Term: Develop a long-term tax strategy aligned with your business goals to maximize benefits over time.

Tax planning is important for small business owners. At Meru Accounting, we provide comprehensive tax planning services for small businesses. Through careful record-keeping and the guidance of professionals at Meru Accounting, businesses can minimize tax liabilities, maximize deductions, and choose optimal legal structures. Meru Accounting’s expertise ensures small businesses capitalize on incentives, make informed financial decisions, and manage the complex tax landscape effectively.