Effective bookkeeping for real estate investors is essential for managing finances and optimizing profits. It involves keeping thorough records of income and expenses related to real estate properties. This precise record-keeping allows investors to track cash flow, evaluate property performance, and make informed decisions for future investments. Maintaining accurate records simplifies tax preparation and ensures compliance with regulations. Real estate bookkeeping is vital for staying organized, maximizing profitability, and fulfilling financial obligations.

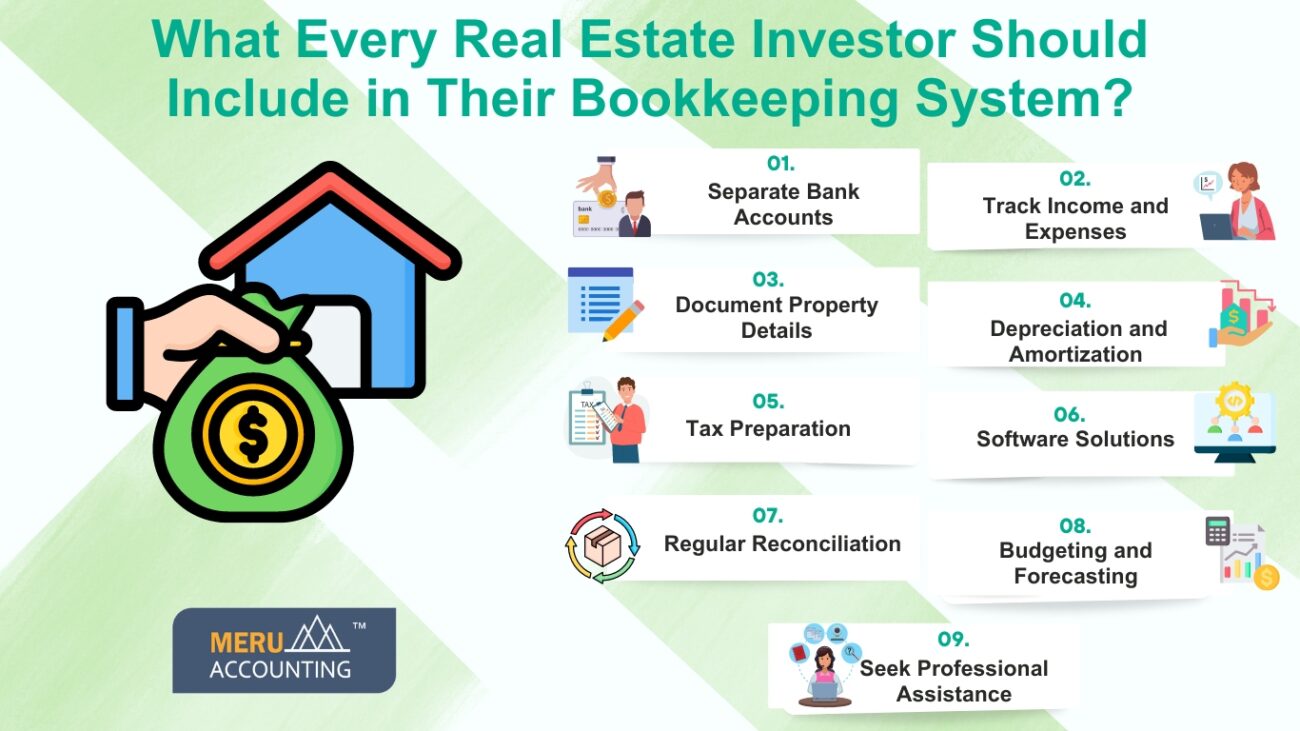

The key components every real estate investor should include in their bookkeeping system are as follows:

1. Separate bank accounts:

For efficient real estate bookkeeping, establish separate bank accounts specifically for your property investments. It’s crucial to keep your personal and business finances separate. This practice ensures clarity in tracking income and expenses related to your real estate ventures. By maintaining distinct accounts, you simplify the process of real estate bookkeeping, making it easier to manage your financial records effectively.

2. Track Income and Expenses:

In real estate bookkeeping, it’s crucial to precisely document all sources of income, such as rent payments and property sales, along with any other revenue streams. Similarly, it’s important to accurately track expenses, including mortgage payments, property taxes, maintenance costs, and utilities. This level of detailed record-keeping is essential for understanding cash flow and making well-informed financial decisions for real estate investors.

3. Document Property Details:

Ensure precise bookkeeping for real estate investors by maintaining detailed records for each property in your portfolio. These records should include essential information such as the purchase price, acquisition date, renovation costs, and any other relevant details. This comprehensive documentation is essential for accurately calculating depreciation, determining property value, and assessing investment performance over time.

4. Depreciation and amortization:

In bookkeeping for real estate investors, it’s crucial to use depreciation and amortization schedules to track the gradual decline in the value of properties and associated loan payments. These accounting methods play a vital role in accurately managing taxable income and planning for long-term financial goals.

5. Tax Preparation:

Stay organized for tax season by categorizing expenses properly and retaining all relevant documentation. Familiarize yourself with tax deductions and credits available to real estate investors, such as mortgage interest, property taxes, and depreciation. Proper bookkeeping not only simplifies tax filing but also ensures compliance with regulatory requirements.

6. Software Solutions:

Invest in bookkeeping software tailored to real estate investors, such as QuickBooks or Buildium. These platforms offer features specifically designed for property management, simplifying tasks like rent collection, expense tracking, and financial reporting.

7. Regular Reconciliation:

Reconcile your accounts regularly to identify discrepancies and ensure accuracy in your financial records. This process involves comparing your bookkeeping entries with bank statements to catch errors or fraudulent activity promptly.

8. Budgeting and Forecasting:

Create budgets and forecasts to plan for future expenses, anticipate cash flow fluctuations, and set financial goals. Regularly review your budget against actual performance to identify areas for improvement and adjust your investment strategy accordingly.

9. Seek professional assistance.

Consider hiring a qualified accountant or bookkeeper with experience in real estate investment. A professional can provide expert guidance, ensure compliance with tax laws, and offer valuable insights to optimize your financial management practices.

At Meru Accounting, we understand the critical importance of effective bookkeeping for real estate investors. Our tailored approach focuses on integrating key elements into your real estate bookkeeping system to ensure accurate financial records, maximize tax benefits, and facilitate informed investment decisions. With Meru Accounting, you can confidently manage the complexities of real estate bookkeeping, knowing you have professional support every step of the way.