Bank Account Reconciliation for Financial Success

Bank account reconciliation is the process of comparing your bank statement with your own records to ensure that they match up. It’s like playing detective, trying to find any discrepancies or errors that may have occurred during the month. We can think of it as a way to double-check and verify all the transactions that have taken place in your account. This includes deposits, withdrawals, fees, and any other activity related to your financial transactions.

By reconciling your bank account regularly, you can catch any mistakes or fraudulent activity early on. It gives you peace of mind knowing that everything is in order and there are no surprises lurking in your finances. During the reconciliation process, you’ll be able to identify any missing transactions or unauthorized charges. This allows you to take immediate action by contacting your bank and resolving these issues promptly.

Are you tired of feeling like your bank account is a mystery? Do you find yourself scratching your head every time you try to make sense of all those transactions? Bank account reconciliation can easily help you out and bring some much-needed clarity into your financial life. In this blog, we will explore what bank account reconciliation is, why it is important, and most importantly, the dos and don’ts that will help you achieve financial success.

Why is Bank Account Reconciliation Important?

Bank account reconciliation is an essential practice for maintaining financial success. By comparing your records with your bank statement, you can ensure that all transactions are accurately recorded and accounted for. This process helps identify any discrepancies or errors that may have occurred, allowing you to rectify them promptly.

One of the primary reasons why bank account reconciliation is important is because it helps detect fraudulent activity or unauthorized charges. By reviewing each transaction carefully, you can spot any suspicious activity and take immediate action to protect your finances.

Additionally, reconciling your bank accounts regularly allows you to have a clear understanding of your current financial position. It provides accurate insights into your cash flow, expenses, and income streams. This information enables you to make informed decisions regarding budgeting, investments, and savings goals.

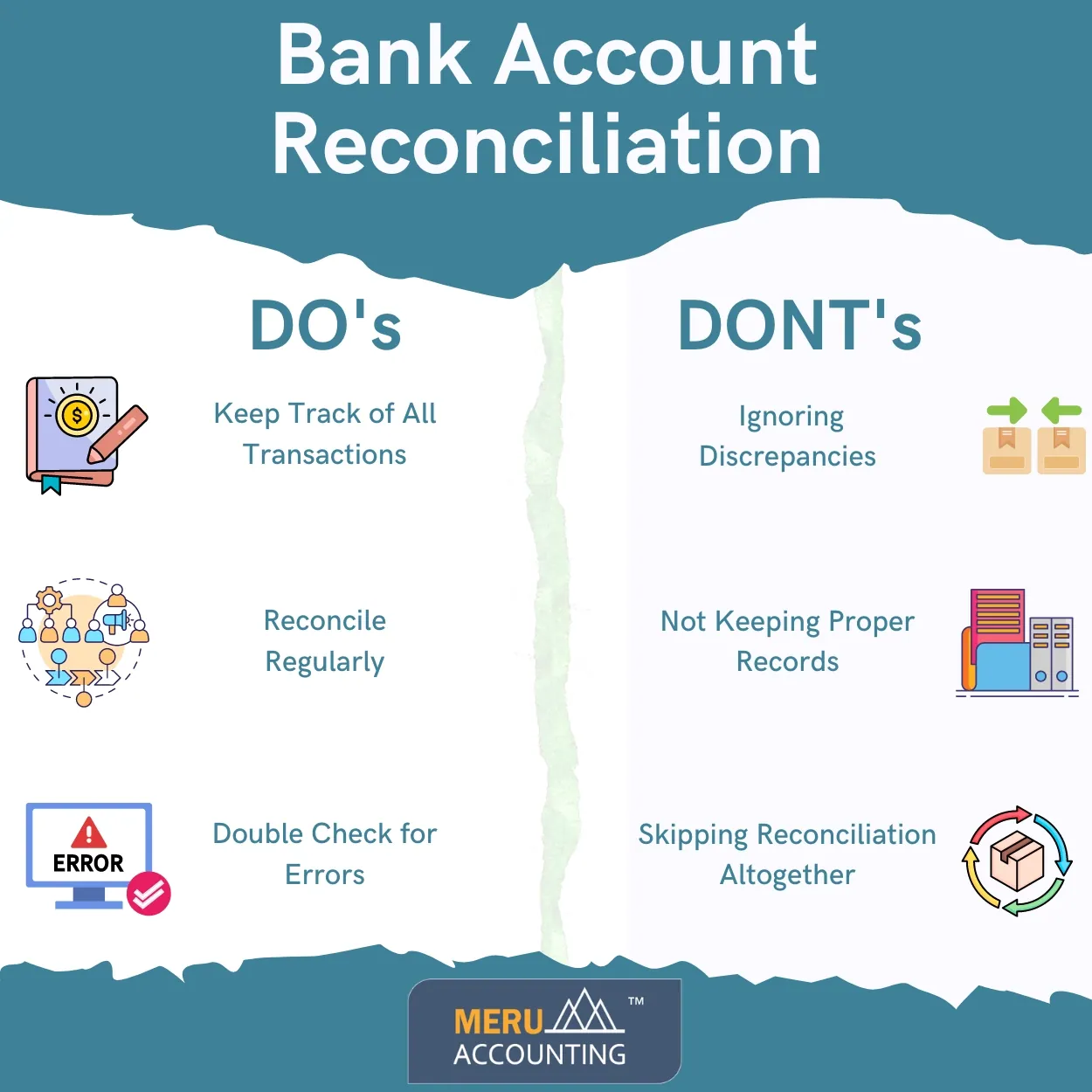

The Dos of Bank Account Reconciliation

A. Keep Track of All Transactions

- Importance of Transaction Tracking: Essential for successful bank account reconciliation.

- Accurate Recording: Crucial for identifying discrepancies between records and bank statements.

- Recording Methods: Maintain a detailed register or utilize digital tools for efficient tracking.

- Accuracy: Double-check entries to prevent errors and ensure precise financial records.

B. Reconcile Regularly

- Consistent Reconciliation: Establish a regular schedule for reconciliation.

- Thorough Review: Double-check transactions against records to catch errors early.

- Organized Documentation: Keep receipts and statements organized for efficient reconciliation

- Technological Assistance: Utilize software tools for streamlined reconciliation processes.

C. Double Check for Errors

- Vital Step: Crucial in maintaining accurate financial records and detecting discrepancies.

- Thorough Review: Carefully examine each transaction for discrepancies or inconsistencies.

- Identifying Hidden Fees: Scrutinize statements for unexpected charges or bank errors.

- Importance of Accuracy: Even minor errors can disrupt the reconciliation process; careful checking is essential.

The Don’ts of Bank Account Reconciliation

A. Ignoring Discrepancies

- Significance of Addressing Discrepancies: Ignoring minor differences can lead to larger financial issues.

- Potential Consequences: Inaccurate financial statements, and missed fraudulent activities.

- Importance of Investigation: Even small inconsistencies should be thoroughly investigated to identify underlying problems.

- Prompt Action: Contacting the bank promptly for assistance in resolving discrepancies ensures security and accuracy in financial records.

B. Not Keeping Proper Records

- Essential Role of Proper Records: Crucial for Effective Bank Account Reconciliation.

- Documentation Needed: Receipts, invoices, and bank statements are necessary for accurate tracking.

- Risk of Losing Information: Lack of organized records hinders dispute resolution and financial analysis.

- Insights into Spending Habits: Detailed records provide valuable insights for budgeting and decision-making.

C. Skipping Reconciliation Altogether

- Consequences of Neglecting Reconciliation: Leaves finances vulnerable to errors and fraud.

- Lack of Awareness: Without reconciliation, unaware of discrepancies or unauthorized charges.

- Impact on Budgeting: A missed opportunity to track spending and identify areas for improvement

- Financial Risks: Potential for missed payments or overdraft fees due to lack of oversight.

Tips for Successful Bank Account Reconciliation

1. Set a Schedule: The key to successful bank account reconciliation is consistency. Make it a habit to reconcile your accounts at regular intervals, whether it’s weekly, monthly, or quarterly. This will help you stay on top of your finances and catch any discrepancies early on.

2. Use Technology: Take advantage of accounting software or online banking tools that offer automatic reconciliation features. These tools can save you time and effort by automatically matching transactions from your bank statement with those in your accounting records.

3. Keep Detailed Records: Maintain organized and accurate financial records for easy reference during the reconciliation process. This includes retaining receipts, invoices, and other supporting documents related to your transactions.

4. Investigate Discrepancies: If you come across any discrepancies between your bank statement and accounting records, don’t ignore them! Take the time to investigate these differences thoroughly to identify the root cause and rectify any errors.

5. Collaborate with Your Team: If you have a team responsible for managing finances within your organization, ensure clear communication regarding reconciliations processes and expectations. Regularly review their work together to maintain accuracy.

6. Seek Professional Help if Needed: If reconciling accounts becomes overwhelming or complex due to complex financial transactions or large volumes of data, consider seeking assistance from a professional accountant who specializes in this area.

Conclusion

The practice of bank reconciliation can be considered the foundation for financial integrity and success. At Meru Accounting, we understand the importance of precisely aligning bank account reconciliation with prudent financial management. By adhering to the outlined dos and don’ts, individuals and businesses can fortify their fiscal foundations, ensuring transparency, accuracy, and resilience in the face of potential discrepancies or fraudulent activities.

We cannot ignore the significance of bank reconciliation in businesses. The dos mentioned in this blog serve as guiding principles and the don’ts as cautionary signals. Through consistent reconciliation practices, leveraging cutting-edge technology, and nurturing a collaborative relationship with our clients, we endeavor to uphold the highest standards of accuracy and integrity in every financial endeavor. Contact us and manage the complexities of bank reconciliation ensuring that every transaction is reliable and can be trusted.

FAQs

1. What is bank account reconciliation, and why is it important?

Bank account reconciliation is the process of comparing your own financial records with your bank statement to ensure they match. It’s crucial for detecting errors, discrepancies, or fraudulent activities, helping maintain accurate financial records, and protecting your finances.

2. How often should I reconcile my bank account?

It’s recommended to reconcile your bank account regularly, whether it’s weekly, monthly, or quarterly. Consistent reconciliation helps catch any discrepancies early on and ensures financial accuracy.

3. What are the benefits of using technology for bank account reconciliation?

Technology, such as accounting software or online banking tools, offers automatic reconciliation features, saving time and effort by matching transactions from your bank statement with your records. This streamlines the reconciliation process and reduces the chance of errors.

4. Why is it important to keep detailed records for bank account reconciliation?

Maintaining organized and accurate financial records, including receipts, invoices, and bank statements, is essential for reference during the reconciliation process. Detailed records provide insights into spending habits, aid in dispute resolution, and support financial analysis.

5. What should I do if I encounter discrepancies during bank account reconciliation?

If you come across any discrepancies between your bank statement and accounting records, it’s crucial not to ignore them. Investigate these differences thoroughly to identify the root cause and rectify any errors promptly.

6. When should I seek professional help for bank account reconciliation?

If reconciling accounts becomes overwhelming or complex due to complex financial transactions or large volumes of data, consider seeking assistance from a professional accountant or firm like Meru Accounting, which specializes in this area. Professional help can ensure accuracy and efficiency in the reconciliation process.