In real estate bookkeeping, bank account reconciliation is a crucial process that ensures financial accuracy and integrity. Keeping a close eye on your finances is paramount, and reconciling your bank accounts regularly can prevent costly mistakes.

What is Bank Account Reconciliation?

Bank account reconciliation is reconciling your company’s financial records with bank statements. This practice helps to recognize errors, such as missing transactions, errors, or unauthorized activities. By routinely reconciling your accounts, you can ensure that your financial records are accurate and up-to-date.

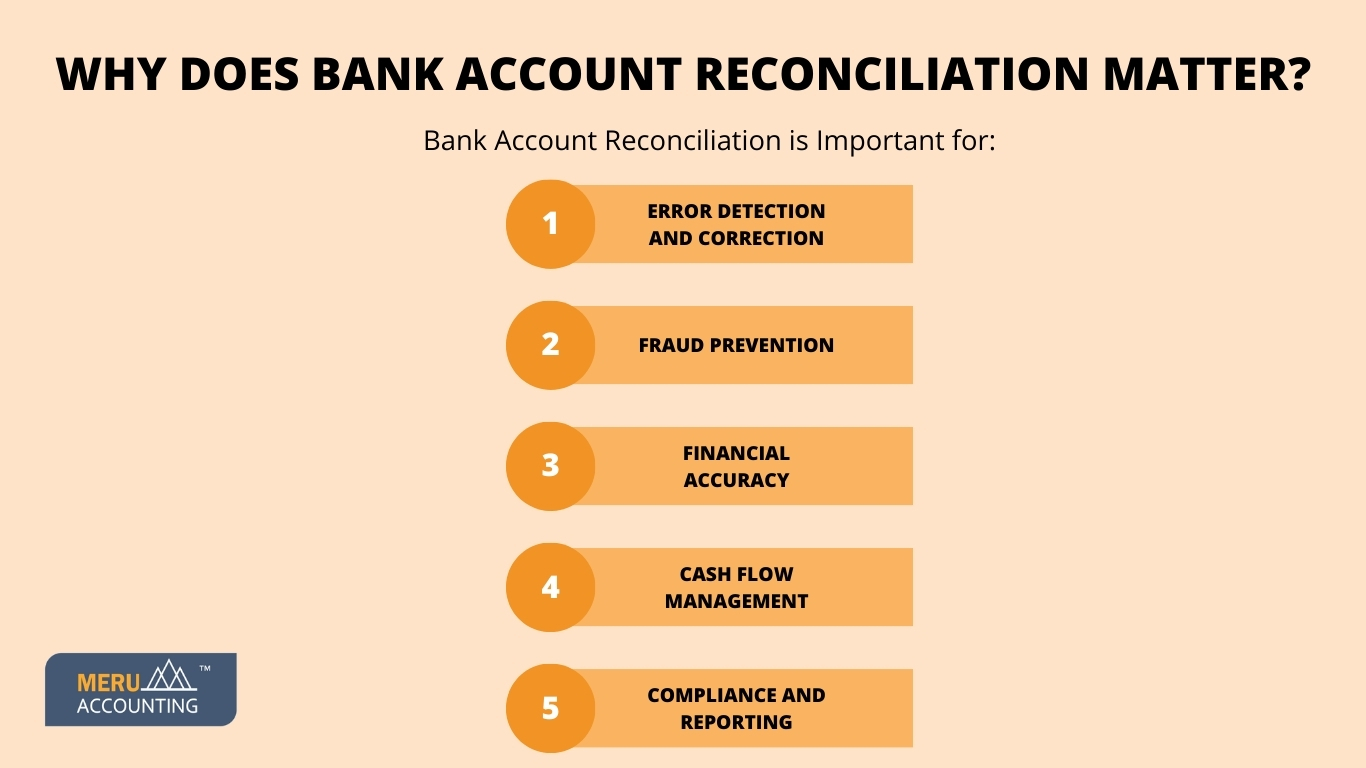

Why is Bank Account Reconciliation Important?

- Error Detection and Correction: Bank reconciliation helps in spotting errors made by either the bank or within your bookkeeping. Catching these mistakes early can save time and prevent further complications.

- Fraud Prevention: Reconciling your bank accounts regularly can help detect suspicious activities. You can easily recognize any fraudulent transactions by comparing your records to those of the bank.

- Financial Accuracy: Ensuring your financial records are accurate is vital for making informed business decisions. Bank account reconciliation helps in maintaining this precision, providing a clear picture of your financial health.

- Cash Flow Management: Accurate financial records allow for better cash flow management. Knowing exactly how much money is available can help in planning and avoiding cash shortages.

- Compliance and Reporting: For real estate businesses, compliance with financial regulations is essential. Bank reconciliation ensures your records are complete and accurate, making it easier to comply with legal requirements and prepare financial reports.

Benefits for Real Estate Businesses

- Enhanced Decision Making: Accurate financial records provide a solid foundation for making strategic business decisions. Knowing your exact financial position allows for better planning and investment.

- Improved Trust and Credibility- Maintaining accurate and reconciled accounts enhances the trust and credibility of your real estate business. Clients and investors are more likely to believe in your financial stability.

- Time and Cost Efficiency- Catching and correcting errors early can save significant time and costs associated with resolving financial discrepancies. This helps you focus more on growing your business.

Best Practices for Effective Bank Reconciliation

- Consistency is Key: Don’t forget to include bank reconciliation as a regular part of your monthly routine to keep track of your finances.

- Use Technology: Make sure to use accounting software that can help simplify the process of matching your records with your bank statements.

- Keep Detailed Records: Make sure to record every transaction promptly and accurately to make the reconciliation process easier.

- Review and Verify: Remember to always double-check your work or have another team member review the bank reconciliations for added accuracy.

Bank account reconciliation is essential for real estate bookkeeping. Partnering with a trusted company like Meru Accounting ensures that your finances are accurate, helps prevent fraud, and ensures compliance with regulations. Making bank reconciliation a regular habit is essential for the financial health and success of your real estate business.