Where to Find the Best Tools for Automating Accounts Receivable

Efficient financial management is essential for success, and a key area where companies can benefit from automation is accounts receivable—the process of tracking money owed by customers. Automated accounts receivable tools help businesses streamline invoicing, monitor payments, and even forecast cash flow, reducing manual effort and improving cash flow reliability. By using these tools, companies can simplify their accounts receivable process, ensuring that payments are received on time and financial records stay up-to-date.

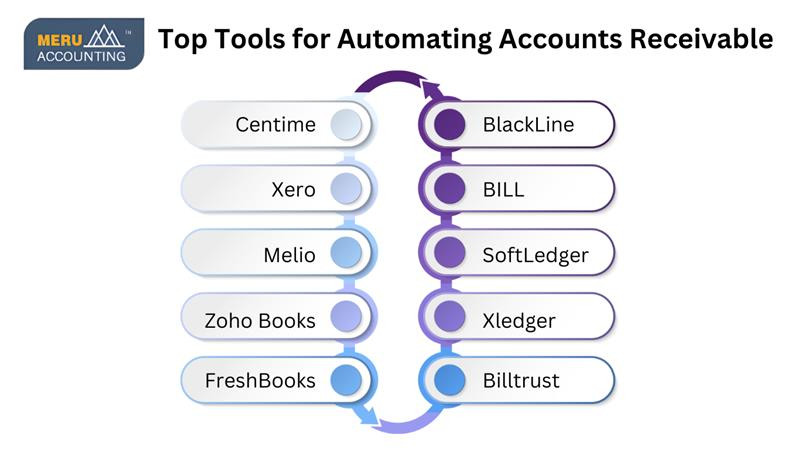

Best Tools to Automate Accounts Receivable

- Centime: Centime is a smart choice for businesses needing real-time cash flow forecasting. It offers a complete financial management solution that includes automation for both accounts receivable and payable. Centime’s tools allow businesses to predict their cash flow accurately by monitoring outstanding invoices and ensuring payments are received promptly.

- Xero: Xero is known for its simplicity, especially in creating and sending invoices for accounts receivable. It’s user-friendly and integrates well with other business tools, making it a popular choice for small to medium-sized companies that want easy-to-manage invoicing solutions.

- Melio: Melio provides flexible payment options, which simplifies the accounts receivable process for clients. With Melio, businesses can accept payments in various ways, making it easier for clients to pay invoices and leading to quicker cash flow.

- Zoho Books: Zoho Books is ideal for businesses already using Zoho products, as it integrates seamlessly with them. This accounts receivable tool comes with features like invoicing, expense tracking, and payment management, helping businesses keep their financial operations smooth and centralized.

- FreshBooks: FreshBooks is great for small teams, providing straightforward accounts receivable management with invoicing, expense tracking, and time tracking features. Its simple design is perfect for freelancers or small businesses that need a reliable invoicing tool without unnecessary complexity.

- BlackLine: If your business requires robust credit and risk management, BlackLine is a strong choice for accounts receivable. With powerful credit risk monitoring tools, BlackLine ensures compliance with accounting standards, making it ideal for larger companies that want to manage credit risk effectively.

- BILL: BILL automates both accounts receivable and payable processes, providing businesses with an all-encompassing billing solution. It simplifies tracking and managing cash flow from both directions, ensuring accurate record-keeping and timely payment reminders.

- SoftLedger: For businesses with unique billing needs, SoftLedger offers customizable accounts receivable solutions. This tool can be tailored to meet specific requirements, making it ideal for companies with specialized invoicing or billing processes.

- Xledger: Xledger is a powerful accounts receivable tool for businesses with multi-entity structures. It provides advanced multi-entity financial management, making it perfect for companies with multiple branches or subsidiaries, ensuring that all entities’ finances are efficiently managed in one place.

- Billtrust: Billtrust focuses on automating credit decisions and accounts receivable management. With features designed to streamline credit approvals, Billtrust ensures that businesses can reduce overdue payments and simplify their cash flow tracking.

Conclusion

Automating accounts receivable helps businesses save time, minimize errors, and get paid faster. Whether you need simple invoicing, multi-entity financial management, or comprehensive credit monitoring, there’s a solution that suits your business needs. Accounts Junction can guide you in choosing and implementing the right accounts receivable tools, ensuring your business has consistent, reliable cash flow management. With professional support, your financial operations can stay efficient and effective.