Accounts receivable management is a critical aspect of any business’s financial health. Efficient management of accounts receivable ensures steady cash flow and enhances overall profitability.

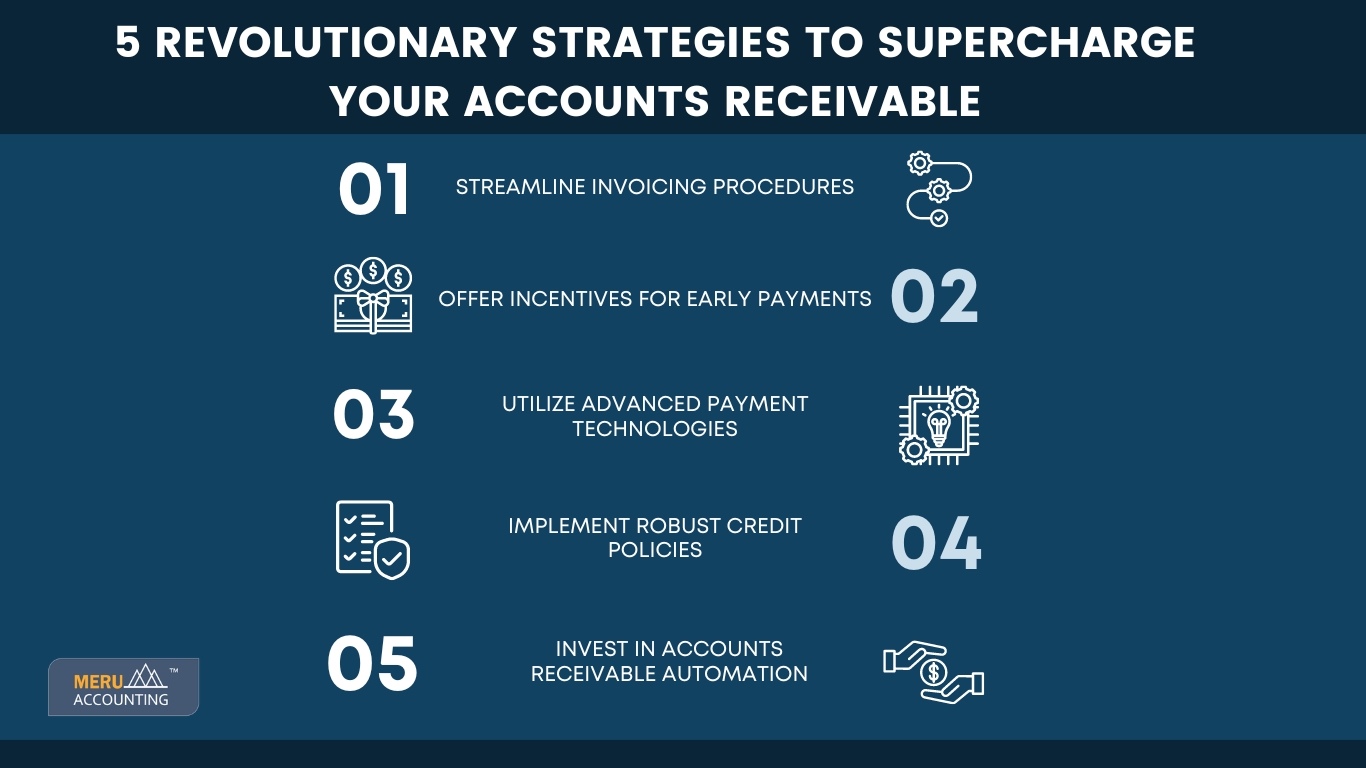

Here are five revolutionary strategies to optimize your accounts receivable process and boost your bottom line:

- Streamline Invoicing Procedures: By using simplified invoicing procedures, you can speed up the process of getting paid. Use automated invoicing systems to create and send invoices quickly. This helps reduce mistakes and ensures that clients receive their invoices without delay. Also, make sure to clearly state payment terms and deadlines on the invoices to encourage prompt payments.

- Offer Incentives for Early Payments: To get clients to pay on time, you can offer them rewards for paying early. For example, you could give them discounts or other benefits if they pay their invoices before the due date. This not only encourages clients to pay promptly but also helps to strengthen your relationship with them. Make sure to communicate these incentives on the invoices to make sure clients are aware of them and to maximize their impact.

- Utilize Advanced Payment Technologies: Remember to use modern payment methods like electronic funds transfer (EFT) and online payment gateways to get paid faster. Having multiple ways to pay makes it easier for clients to settle their bills on time. Electronic payments also reduce the risk of delays that come with traditional paper transactions.

- Implement Robust Credit Policies: Develop robust credit policies to assess the creditworthiness of potential clients before extending credit terms. Conduct thorough credit checks and establish credit limits based on clients’ financial stability and payment history. Communicate credit policies to clients and enforce them consistently to mitigate the risk of late or defaulted payments.

- Invest in Accounts Receivable Automation: Use accounts receivable automation software to make repetitive tasks easier and more efficient. With automation, you can create invoices, send payment reminders, and reconcile accounts, giving your finance team more time to focus on important projects. Automation also helps reduce mistakes and ensures accuracy in billing.

Optimizing your accounts receivable process is essential for maintaining healthy cash flow and maximizing profitability. By choosing a partner like Meru Accounting you can supercharge your accounts receivable management and drive sustainable financial growth for your business. Stay proactive, embrace technology, and prioritize efficiency to unlock the full potential of your accounts receivable department.