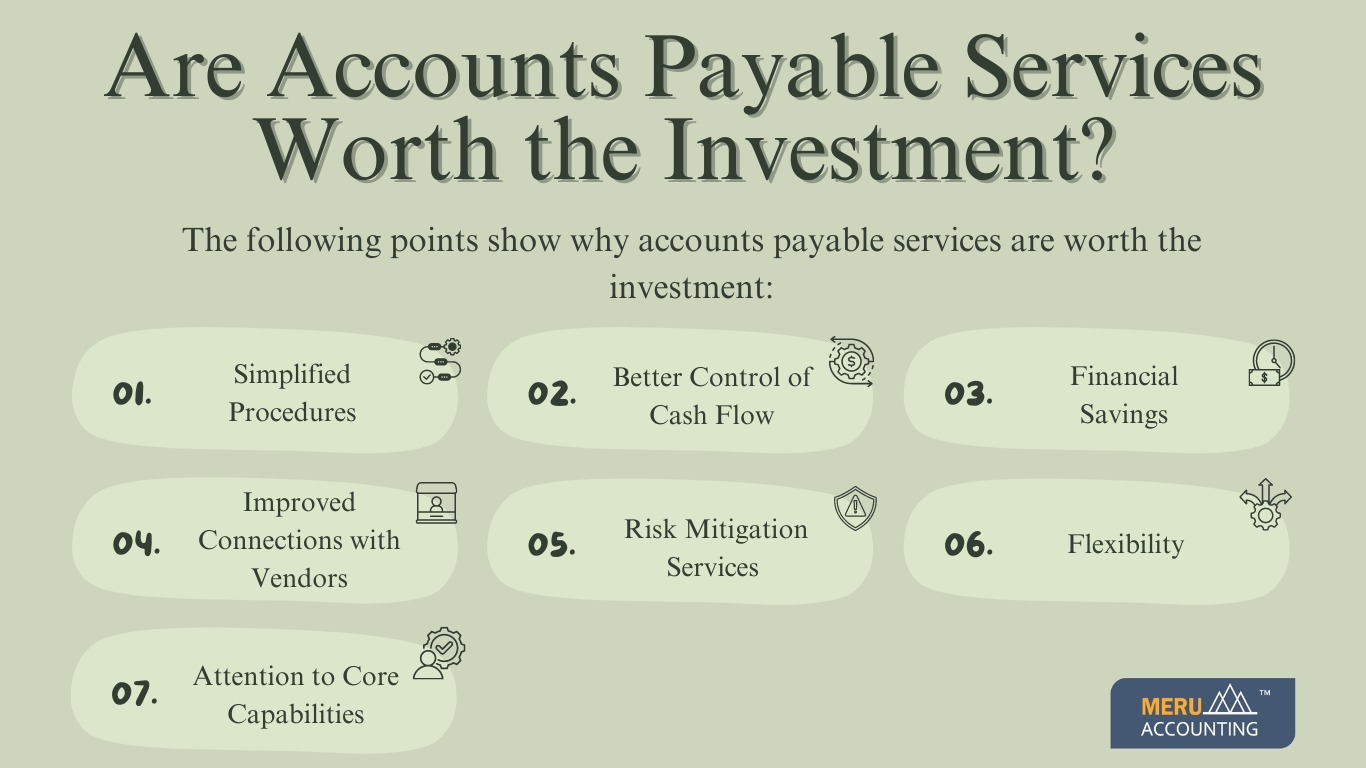

Are Accounts Payable Services Worth the Investment?

Optimizing cost-effectiveness and efficiency is crucial for business operations, and accounts payable services are frequently essential to reaching these objectives. But for businesses, deciding whether to invest in these services is valuable can be a difficult choice. We will explore whether accounts payable services are worthwhile investments in this blog. Our goal is to give a thorough knowledge of the value proposition provided by accounts payable services by looking at both the associated issues and obstacles as well as the potential rewards, such as increased accuracy, streamlined processes, and cost savings.

Accounts payable is an important function in any business, involving the management of financial obligations to suppliers and vendors. Many businesses wonder whether investing in accounts payable services is a wise decision. In this blog, we’ll explore the value of accounts payable services and whether they justify the investment.

1. Simplified Procedures

Services for accounts payable can speed up the billing and payment procedures, minimizing human mistakes and saving time. Businesses can increase efficiency and accuracy by automating processes like data entry and invoice processing.

2. Better Control of Cash Flow

Efficient management of accounts payable can assist companies in maximizing their available finances and guaranteeing on-time supplier payments, hence improving cash flow. Better financial stability and liquidity may result from this.

3. Financial Savings

Outsourcing accounts payable services may be less expensive than hiring and educating internal employees. Additionally, companies can reduce the risk of late payments and related penalties by utilizing the knowledge and assets of a professional service provider.

4. Improved Connections with Vendors

Accurate and timely payments can improve connections with suppliers and vendors, leading to better terms, discounts, and opportunities for collaboration. Accounts payable services can help businesses maintain positive vendor relationships through consistent and reliable payment practices.

5. Risk Mitigation

Services for accounts payable can assist companies in lowering their risk of fraud, double payments, and non-compliance. To protect financial transactions, service providers follow legal regulations and use innovative security measures.

6. Access to Advanced Technology

Sophisticated software and technological platforms that may be too costly for small and medium-sized firms to adopt on their own are frequently used in outsourced accounts payable services. This technology can increase productivity and offer insightful financial data.

7. Flexibility

Services related to accounts payable can be expanded or contracted out to meet the demands of the company, allowing for variations in transaction volume and operational shifts or expansion. Businesses may continue to run effective accounts payable procedures as they grow because of this scalability.

8. Pay Attention to Core Capabilities

Contracting out accounts payable allows businesses to focus on their core competencies and strategic initiatives without any obstructions by administrative tasks. Businesses can allocate resources more effectively by delegating accounts payable functions to experts.

Conclusion

Meru Accounting provides complete accounts payable services that meet all the unique requirements of different businesses. Our focus is on efficiency, accuracy, and cost-effectiveness. We assist companies in streamlining their accounts payable procedures and reaching their budgetary objectives. Our team of skilled experts uses best practices and innovative technologies to produce outstanding results. You can focus on expanding your company and gain peace of mind by working with Meru Accounting for your accounts payable requirements.