How do Accounts Payable services Ensure Compliance with Financial Regulations?

In every business, keeping up with financial regulations is essential. Accounts payable services play a big role in making sure businesses follow these rules. Accounts payable is the process of managing payments to suppliers and keeping track of what the business owes. Through careful and organized methods, accounts payable services help businesses maintain accurate records, avoid errors, and meet financial obligations on time. Ensuring compliance with financial regulations is crucial because it helps companies avoid legal issues, reduces the risk of financial loss, and builds trust with stakeholders

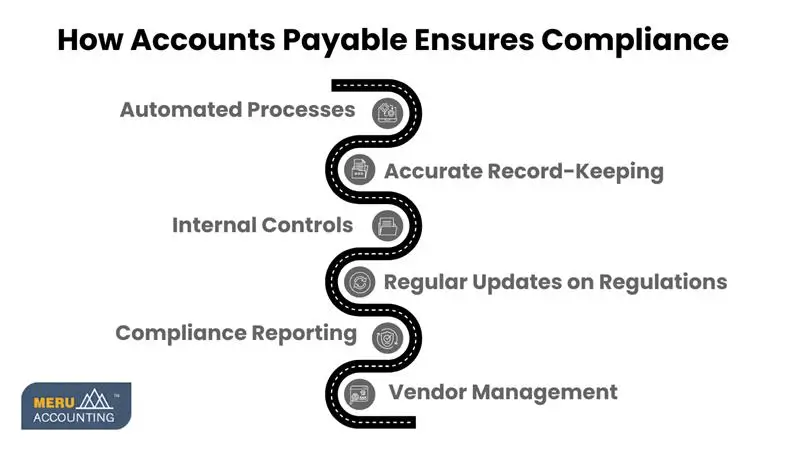

Key Ways Accounts Payable Services Ensure Compliance

1. Automated Processes

- One of the primary methods used by accounts payable services is automation. Automation tools can handle invoicing, payment processing, and expense tracking with accuracy and efficiency. By automating these tasks, businesses reduce the chance of human error, which can lead to mistakes that violate financial regulations. Automation also speeds up payment processes, which helps keep things running smoothly and on time, ensuring that businesses follow the timelines required for payments and avoid late fees or penalties.

2. Accurate Record-Keeping

- Keeping accurate and detailed records is a critical part of accounts payable. Accounts payable services ensure that every transaction, invoice, and payment is recorded properly. This includes having digital copies of all invoices and receipts, which makes tracking expenses and auditing records easier. When records are well-organized, it becomes simpler to prove that all payments and transactions meet regulatory standards. Accurate record-keeping also makes it easier to spot any irregularities or issues in payments before they become serious problems.

3.Internal Controls

- Internal controls are checks and balances within the accounts payable process to prevent errors and fraud. Accounts payable services put strong internal controls in place, such as separating duties among team members and conducting regular audits. For example, one person may approve a payment, while another processes it. These steps reduce the chance of unauthorized transactions and ensure that payments are made following the rules. Regular audits also help detect any potential issues early on, providing a layer of security to meet compliance standards.

4. Regular Updates on Regulations

- Financial regulations can change frequently, and accounts payable services stay updated on these changes. By keeping up-to-date, they can adjust practices as needed to ensure that the business remains compliant. This proactive approach helps prevent penalties that could arise from not meeting the latest standards. For instance, if new tax reporting requirements come into effect, accounts payable services will adjust their processes accordingly, ensuring accurate and compliant filings.

5. Compliance Reporting

- Accounts payable services often create compliance reports to track regulatory requirements, such as tax summaries and input-output reports. These reports provide a clear view of tax liabilities and other regulatory obligations, making it easier for businesses to keep track of and fulfill these requirements. Compliance reporting also helps businesses identify any areas that might need attention to avoid penalties.

6. Vendor Management

- Accounts payable services help with managing vendor relationships by ensuring that payments are made on time and accurately. By handling vendor payments promptly, accounts payable services help businesses avoid any penalties or issues that could arise from late or incorrect payments. This approach not only helps maintain a good relationship with suppliers but also strengthens overall compliance.

Conclusion

Accounts payable services are essential in keeping businesses compliant with financial regulations. By following these key practices—automation, accurate record-keeping, strong internal controls, staying updated on regulations, compliance reporting, and proper vendor management—accounts payable services make it easier for businesses to follow the rules and avoid potential issues. This helps build trust and keeps business operations running smoothly. Meru Accounting offers reliable accounts payable services that ensure accuracy, compliance, and peace of mind.