Accounting Software for Real Estate Business

Bookkeeping is an essential aspect of running any business, and this holds true for real estate firms as well. In fact, bookkeeping plays a crucial role in the success of a real estate firm by keeping track of all financial transactions and providing accurate financial data for decision-making.

Bookkeeping essentially involves recording, classifying, and summarizing the financial transactions of a business. These transactions can include everything from rental income, property management fees, maintenance costs, utility bills, mortgage payments, and more. Keeping track of these transactions can be overwhelming, especially for real estate firms that deal with multiple properties and clients.

Moreover, real estate firms also have to comply with various laws and regulations related to accounting and taxation. This makes it even more important to have a solid bookkeeping system in place. Managing all the financial aspects manually can be time-consuming and prone to errors. That’s where bookkeeping software comes in handy. It automates many processes involved in bookkeeping such as data entry, invoicing, tracking expenses and revenue, generating reports, etc.

But, how do you choose the best accounting and bookkeeping software for your business? In this blog, we will help you select the best bookkeeping software for your real estate business by considering all your requirements.

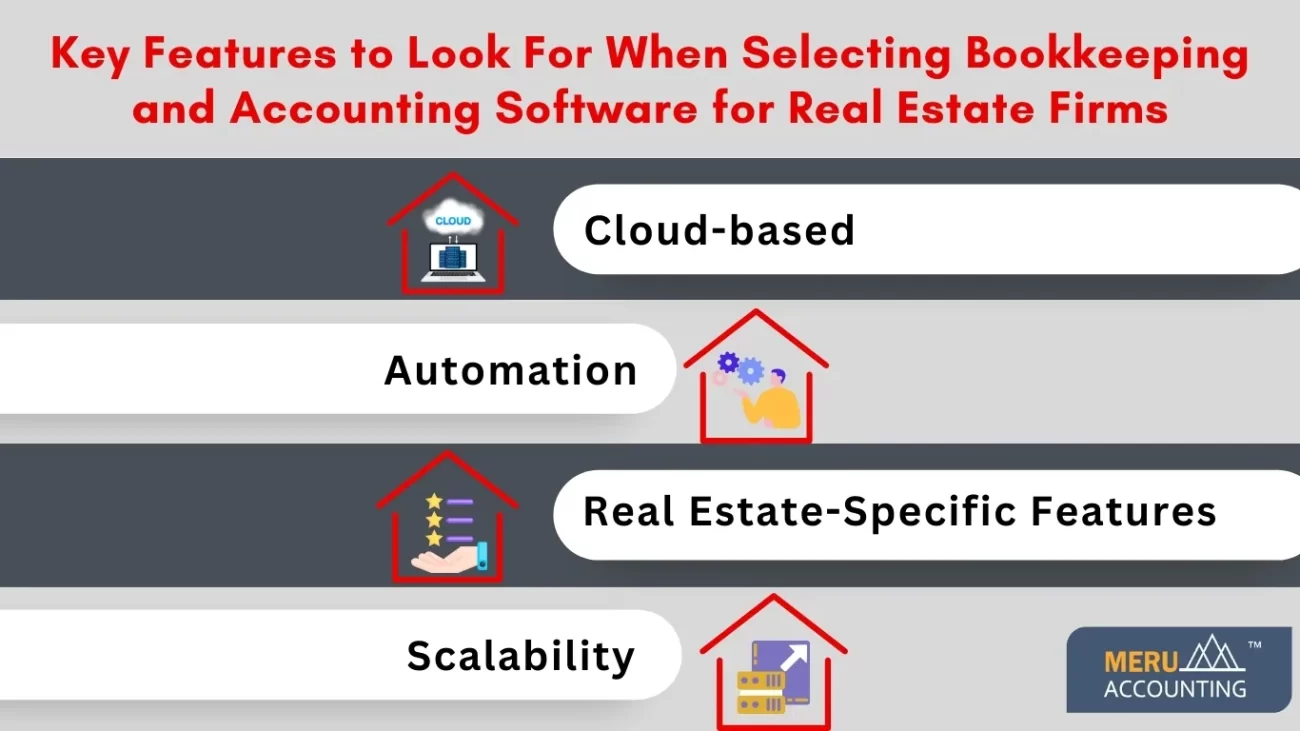

Key Features to Look For When Selecting Bookkeeping and Accounting Software for Real Estate Firms

When choosing accounting software for a real estate firm there are certain key features that you should consider:

Cloud-based: Opting for cloud-based software allows you to access your financial data from anywhere, at any time. This is especially beneficial for real estate firms that have multiple locations or a remote team.

Automation: Look for software that automates processes like invoicing, bill payments, and bank reconciliations. In addition to saving valuable time, this approach also minimizes the likelihood of human errors.

Real Estate-Specific Features: Some software offers industry-specific features such as tenant tracking, lease management, rental income tracking, etc. These features can make bookkeeping much more efficient and accurate for real estate firms.

Scalability: As your business grows so will your bookkeeping needs. Make sure the software you choose can accommodate the growth of your real estate firm and has room for expansion.

Factors to Consider Before Choosing Bookkeeping and Accounting Software for Real Estate Firms

Size and Complexity:

- Consider the scale and complexity of your real estate business.

- Opt for basic software for small firms, while larger, complex operations may benefit from advanced solutions.

User-Friendly Interface:

- Prioritize a user-friendly interface for easy navigation.

- Look for intuitive design and accessibility to key features like invoicing and expense tracking.

Cloud-Based or Desktop-Based:

- Choose between cloud-based and desktop-based software.

- Assess your business needs and preferences for remote access or localized installation.

Integration Capabilities:

- Ensure seamless integration with existing tools like property management systems or CRMs.

- Avoid duplication of work and streamline processes by choosing software that complements your current setup.

Security Measures:

- Look for multi-factor authentication and regular data backup options to guard against cyber threats.

- Emphasize the implementation of strong security measures to safeguard critical financial information against potential breaches.

Customer Support:

- Assess the quality of customer support provided by the software company.

- Research response times and effectiveness through user reviews to ensure reliable assistance during technical issues.

Comparison of Top Bookkeeping and Accounting Software for Real Estate Firms

QuickBooks Online:

- Cloud-based accounting software designed for small businesses, including real estate firms.

- User-friendly interface, customizable dashboard, and integration with property management software.

- Tracks income and expenses, facilitates invoicing, and manages cash flow.

Xero:

- Cloud-based accounting software with a clean interface and intuitive navigation.

- Features include bank reconciliation, budgeting tools, inventory tracking, and custom reporting options.

- Suitable for small businesses, including real estate firms.

FreshBooks:

- Known for invoicing capabilities, it offers comprehensive bookkeeping features.

- Includes expense tracking, time tracking, project management tools, and financial reports.

- Mobile app for on-the-go financial management.

Buildium:

- All-in-one property management solution with robust accounting functionalities.

- Automates rent collection generates owner statements, handles maintenance requests, and tracks vacancies.

- Specifically designed for landlords and property managers in the real estate industry.

AppFolio Property Manager:

- Combines advanced bookkeeping capabilities with property management features.

- Tools for online rent collection, budgeting, tenant screening, maintenance tracking, and financial reporting.

- Tools for online rent collection, budgeting, tenant screening, maintenance tracking, and financial reporting.

Sage Intacct:

- Cloud-based financial management solution for small to mid-sized businesses.

- Features include accounts payable/receivable, cash management, general ledger, and project accounting.

- Customizable dashboards and automated workflows streamline bookkeeping processes.

You must carefully analyze the unique features and advantages that each solution provides when choosing the finest bookkeeping software. With its accessible and user-friendly layout, QuickBooks Online stands out as a great option. At Meru Accounting, we utilize almost every bookkeeping software to meet the unique requirements of our clients. We also help in choosing appropriate software for your real estate business by considering your goals and needs. Contact us now and find the best bookkeeping software for your real estate business.

FAQs

- Why is bookkeeping important for real estate firms?

Bookkeeping is crucial for real estate firms as it helps in recording, classifying, and summarizing financial transactions. It provides accurate financial data for decision-making, ensures compliance with accounting regulations, and supports the overall success of the business.

- What specific financial transactions does bookkeeping software help manage for real estate firms?

Bookkeeping software assists in tracking various transactions, including rental income, property management fees, maintenance costs, utility bills, mortgage payments, and more. It helps organize and manage these transactions efficiently.

- How does cloud-based bookkeeping software benefit real estate firms?

Cloud-based software allows real estate firms to access financial data from anywhere, providing flexibility for businesses with multiple locations or remote teams. This enhances collaboration and ensures real-time accessibility to critical financial information.

- What are the key features to look for when selecting bookkeeping software for real estate firms?

Important features include cloud-based accessibility, automation capabilities (such as invoicing and bank reconciliations), real estate-specific functionalities (tenant tracking, lease management), and scalability to accommodate business growth.

- How does bookkeeping software contribute to the automation of tasks?

Bookkeeping software automates manual tasks involved in traditional methods, including data entry, bank reconciliations, and invoice generation. Not only does this streamline processes, but it also significantly mitigates the risk of human error, enhancing overall efficiency and accuracy.

- How does bookkeeping software enhance decision-making for real estate firms?

Accurate financial records provided by bookkeeping software are crucial for making informed business decisions. Real-time access to financial data allows real estate firms to strategize effectively regarding budgeting, investments, and pricing strategies.