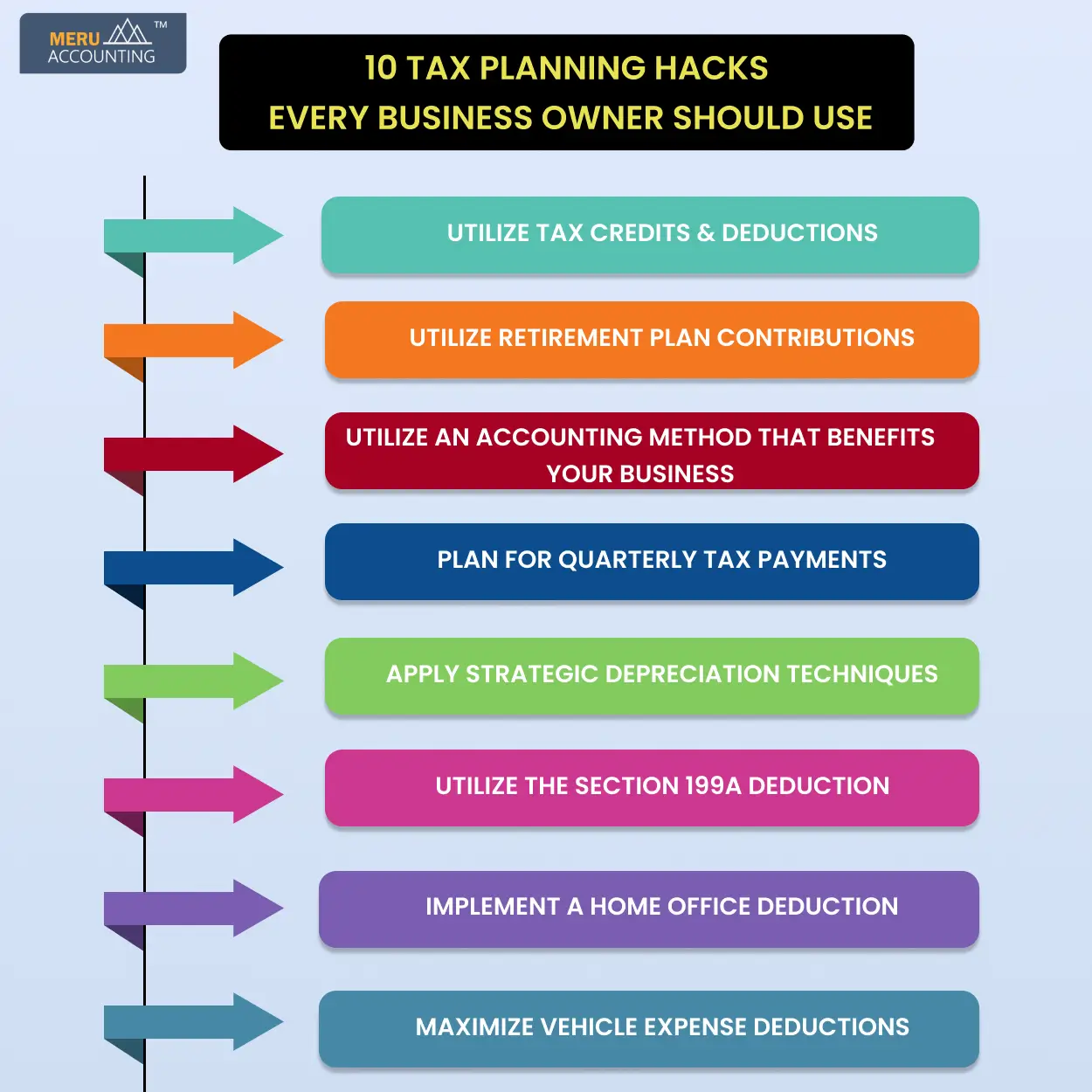

Effective tax planning is crucial for small business owners seeking to optimize their financial performance and minimize liabilities. Utilizing comprehensive tax planning services for small businesses can make a significant difference in maintaining financial health and ensuring compliance. Here are 10 tax planning hacks every small business owner should consider to simplify their financial operations and maximize their savings.

-

Utilize Tax Credits and Deductions

Understanding and applying for available tax credits and deductions is a fundamental aspect of tax planning. Small businesses can benefit from credits for activities like research and development, energy efficiency improvements, and hiring employees from certain target groups. Deductions related to business expenses such as office supplies, utilities, and travel can also significantly reduce taxable income.

-

Utilize Retirement Plan Contributions

Establishing a retirement plan, such as a SEP IRA or 401(k), offers dual benefits: it reduces your taxable income and helps secure your future. Contributions to these plans are generally tax-deductible, making them a powerful tool in your tax planning strategy.

-

Utilize an Accounting Method That Benefits Your Business

Choosing the right accounting method—whether cash or accrual—can impact how and when income and expenses are recognized. For many small businesses, switching to a cash-based accounting method can defer income and expenses, potentially leading to tax savings in the short term. Consulting with tax planning services for small businesses can help determine the most advantageous method.

-

Plan for Quarterly Tax Payments

Avoiding underpayment penalties requires proactive planning for quarterly tax payments. By estimating and paying your taxes quarterly, you can manage cash flow more effectively and avoid underpayment penalties. Regular payments also help manage cash flow and avoid financial strain during tax season.

-

Apply Strategic Depreciation Techniques

Depreciating assets can significantly impact your tax liability. Methods like accelerated depreciation or Section 179 allow you to deduct the cost of assets more quickly. These strategies can provide immediate tax benefits and are essential considerations in comprehensive tax planning.

-

Utilize the Section 199A Deduction

The Section 199A deduction allows eligible businesses to deduct up to 20% of qualified business income. This deduction is available to many small business owners and can result in substantial tax savings. Ensuring eligibility and maximizing this deduction can be achieved with guidance from tax planning services for small businesses.

-

Plan for and Manage Losses

Effective tax planning involves managing losses as well as profits. Businesses experiencing losses can reduce taxable income in profitable years by using losses to offset income through carryforwards or carrybacks. This strategy helps reduce taxable income in profitable years and requires careful planning to ensure you maximize these deductions.

-

Seek Professional Tax Planning Services

Engaging with tax planning services for small businesses provides valuable insights and ensures that your tax strategy is both compliant and optimized. Tax professionals offer expertise in navigating complex tax laws and can tailor strategies to your specific business needs, maximizing your financial outcomes.

-

Implement a Home Office Deduction

Home Office deduction can cover a portion of your home expenses, such as mortgage interest, utilities, and repairs, based on the percentage of your home used for business. Proper documentation is essential to qualify for this deduction and avoid issues with the IRS.

-

Maximize Vehicle Expense Deductions

For small businesses that require travel, maximizing vehicle expense deductions can result in significant tax savings. You can choose between deducting actual expenses (such as gas, maintenance, and depreciation) or using the standard mileage rate. Keeping detailed records of business-related travel, including mileage and expenses, is essential for substantiating tax deductions and avoiding IRS issues.

Conclusion

Incorporating these tax planning hacks into your strategy can greatly enhance your financial management and savings. By utilizing tax planning services for small businesses and applying these best practices, you can achieve a more efficient and effective approach to managing your tax responsibilities. Meru Accounting offers expert services to help small business owners implement essential tax planning hacks. From maximizing deductions and using tax credits to optimizing depreciation and managing retirement plan contributions, our tailored strategies ensure substantial tax savings.