Invoicing Processing: A Game Changer for Businesses

Invoicing processing is an essential part of financial management for businesses worldwide. It refers to the systematic handling of invoices, from creation to payment, ensuring smooth transactions and accurate records. This essential function streamlines financial operations, enhances cash flow management, and develops better relationships with clients and suppliers.

Traditional Invoicing v/s Modern Invoicing

Businesses have long struggled with inefficiencies in Traditional invoicing. This traditional approach is prone to human errors, delays, and reduced accuracy. Businesses now recognize the need to improve their invoicing processes to boost efficiency across their operations.

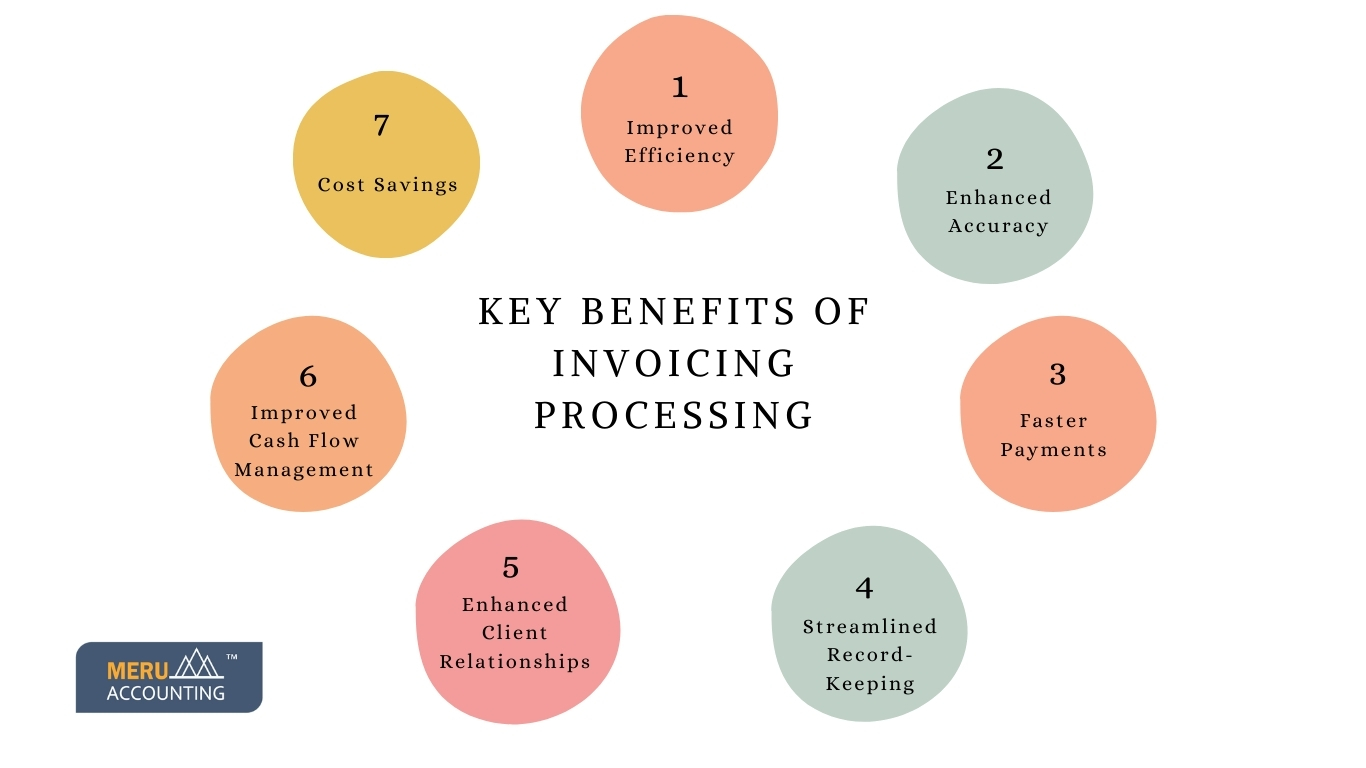

Key Benefits of Invoicing Processing

- Improved Efficiency: Invoicing processing automates repetitive tasks, reducing the time and effort required for manual invoice handling. Automated systems generate invoices, send them to clients electronically, and track payment status, eliminating delays and errors associated with manual processing.

- Enhanced Accuracy: Manual invoicing processes are prone to human errors, leading to discrepancies and delays in payments. Invoicing processing software ensures accuracy by automatically populating invoice details, calculating totals, and applying relevant taxes or discounts, minimizing errors and ensuring compliance with financial regulations.

- Faster Payments: Timely invoicing accelerates the payment cycle, enabling businesses to receive payments promptly and improve cash flow. Automated invoicing systems generate invoices immediately upon completion of services or delivery of goods, reducing the time between invoicing and payment receipt.

- Streamlined Record-Keeping: Invoicing processing with software helps in maintaining a centralized repository of invoices, accessible anytime, anywhere. This facilitates easy retrieval of invoices for reference, auditing, or dispute resolution, streamlining record-keeping and compliance with accounting standards.

- Enhanced Client Relationships: Precise invoicing enhances positive client experiences, boosting trust and loyalty. Automated invoicing systems send professional-looking invoices promptly, reflecting professionalism and reliability, while also providing clients with convenient payment options, further strengthening relationships.

- Improved Cash Flow Management: Efficient invoicing processing enables businesses to better manage their cash flow by ensuring timely payments from clients and prompt settlement of liabilities to suppliers. This proactive approach to financial management enhances liquidity and supports strategic business decisions.

- Cost Savings: Automation of invoicing processes reduces the need for manual intervention, saving businesses time and resources. By eliminating labor-intensive tasks such as data entry and invoice reconciliation, businesses can allocate resources more efficiently, driving cost savings and improving overall profitability.

It is very beneficial for companies to invest in efficient invoicing systems. With automation, businesses can improve their operations, accuracy, and cash flow while also strengthening relationships with clients and suppliers. Embracing technology-driven invoicing solutions helps companies succeed in a competitive marketplace. Partner with Meru Accounting to set up efficient invoicing systems for your business.