Effective accounts payable services management is essential to preserving the financial stability of your company and encouraging positive supplier relationships. But even with the best of intentions, companies can fall victim to errors that make accounts payable procedures more difficult. You can prevent these typical mistakes and improve your financial operations by being aware of them and putting strong accounts payable services in place.

Methods for Optimizing Accounts Payable and Reducing Errors

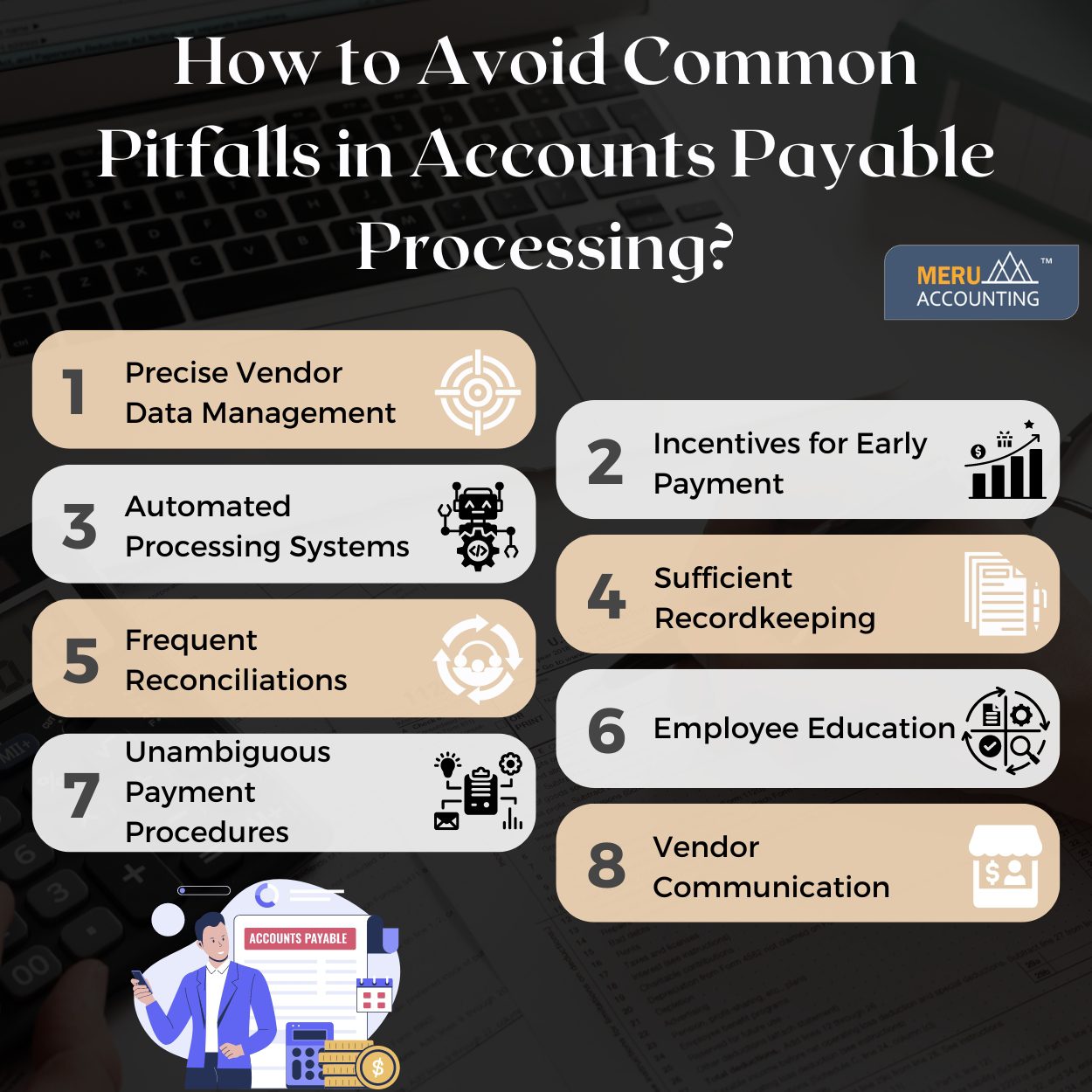

The following eight suggestions will help you streamline your accounts payable services and procedures and help reduce common errors:

1. Precise Vendor Data Management:

Ensure that each vendor’s data is current and accurate. Inaccurate billing or contact information, among other mistakes in vendor data, can cause payment delays and compliance problems.

2. Automated Processing Systems:

To cut down on human mistakes, automate your accounts payable services and procedures. Services for accounts payable that include automation software can help in accurately matching purchase orders, receipts, and invoice data, ensuring that payments are made promptly and correctly.

3. Frequent Reconciliations:

Make sure your general ledger and accounts payable ledger are regularly reconciled. This keeps your financial statements accurate and helps identify inconsistencies early.

4. Unambiguous Payment Procedures:

Clearly define corporate policies for processing workflows, approval hierarchies, and payment timelines. This helps stop fraud by ensuring consistency in the way duties related to accounts payable are handled.

5. Incentives for Early Payment:

If vendors provide discounts for early payment, take advantage of them. This improves supplier connections while simultaneously saving money. Make sure the people handling accounts payable are aware of these savings and can take advantage of them.

6. Sufficient Recordkeeping:

All transactions, including contracts, purchase orders, invoices, and payment receipts, should be meticulously documented. This paperwork can settle disputes and is essential for audits.

7. Employee Education:

Continually educate employees who deal with accounts payable about software tools, best practices, and any modifications to legal requirements. Employees with proper training are more likely to recognize abnormalities and are less likely to make mistakes.

8. Vendor Communication:

Keep the lines of communication regarding your accounts payable services and procedures open with your vendors. This helps in controlling expectations and swiftly resolving problems before they get out of hand.

Conclusion

Meru Accounting helps businesses avoid typical errors and offers invaluable support in optimizing account payment operations. Our team of seasoned specialists uses a methodical approach to manage invoices and payments, ensuring accuracy and promptness. Meru Accounting guarantees that all financial transactions are carried out without errors and preserves the integrity of financial data through the integration of sophisticated automation tools and strict compliance checks.

By guaranteeing that all duties are fulfilled on time and accurately, our services not only lower the chance of inaccurate invoices and late payments but also improve supplier relations. Businesses may get an effective, safe, and reliable accounts payable system by working with Meru Accounting. We allow businesses to concentrate more on strategic expansion and less on the day-to-day complexities of finance.

Summary

How Do You Avoid Common Pitfalls in Accounts Payable Processing?

By implementing these strategies, businesses can minimize errors in their accounts payable processes, enhance efficiency, and maintain robust financial health.

- Precise Vendor Data Management

- Automated Processing Systems

- Frequent Reconciliations

- Unambiguous Payment Procedures

- Incentives for Early Payment

- Sufficient Recordkeeping

- Employee Education

- Vendor Communication