Effective money management can alter everything in the fiercely competitive real estate market. Real estate brokers can utilize QuickBooks, a robust application made specifically to meet the specific accounting requirements of this sector. By streamlining your financial procedures, QuickBooks for real estate may give you a clear picture of your company’s financial health.

Tips for Including QuickBooks for Real Estate Agents in Everyday Tasks

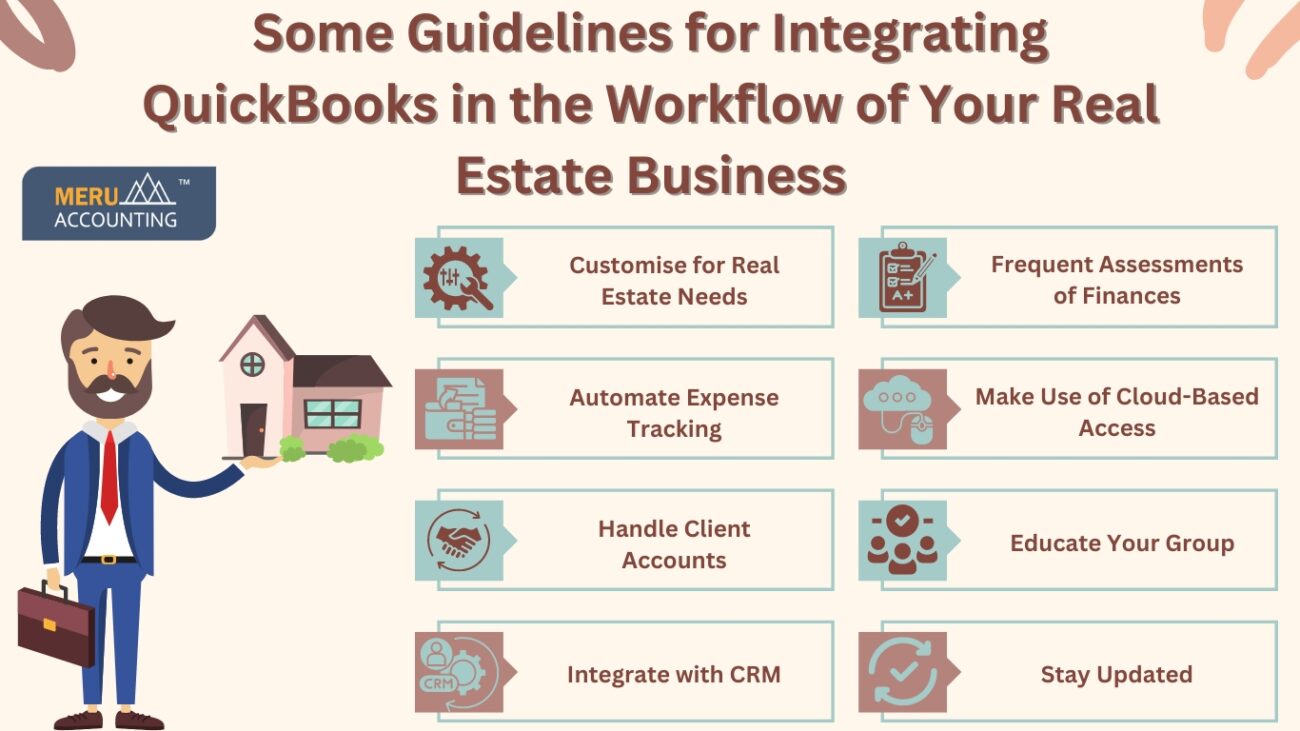

Efficient integration of QuickBooks with your real estate company can improve efficiency and financial clarity. To help you smoothly integrate QuickBooks for real estate into your workflow, consider the following eight essential guidelines:

- Customise for Real Estate Needs: Make QuickBooks for Real Estate unique to your company’s needs. Make changes to your chart of accounts to add real estate-related categories such as commissions, closing costs, and property maintenance costs.

- Automate Expense Tracking: To automate the tracking of all expenses, use QuickBooks for real estate agents. This covers everything, from client meetings to office supplies, ensuring all financial data is reliably recorded without the need for human entry.

- Handle Client Accounts: Real estate agents can handle client deposits, payments, and other transaction-related operations by setting up client accounts in QuickBooks. This helps in keeping each client’s records structured, which is necessary for efficient account administration and reconciliation.

- Integrate with CRM: QuickBooks for real estate should be integrated with a CRM if you utilize it to handle client interactions. By ensuring financial data is consistent across all platforms, this synchronization offers a thorough insight into customer engagements and financial conditions.

- Frequent Assessments of Finances: Plan on reviewing your QuickBooks real estate finance reports frequently. You may make well-informed judgments regarding your business plan by analyzing cash flow figures, profit margins, and other financial statistics.

- Make Use of Cloud-Based Access: To access your financial data remotely, choose a cloud-based version of QuickBooks for real estate agents. Real estate agents who are constantly on the go will find cloud access especially helpful since it lets them handle their accounts from anywhere.

- Educate Your Group: Make sure everyone on your staff has received adequate training on using QuickBooks for real estate. To ensure proper data entry and administration and to improve worker proficiency, consider funding QuickBooks training sessions.

- Stay Updated: Maintain the most recent version of your QuickBooks for Real Estate software to benefit from the newest features and security upgrades. Updates regularly help protect your data and keep software operating efficiently.

Summary

Some Guidelines for Integrating QuickBooks in the Workflow of Your Real Estate Business

Implementing QuickBooks for real estate can greatly enhance your real estate company’s financial management. Real estate brokers can optimize the advantages of QuickBooks by adhering to these suggestions, which can improve everything from overall business performance to financial accuracy and efficiency:

- Customise for Real Estate Needs

- Automate Expense Tracking

- Handle Client Accounts

- Integrate with CRM

- Frequent Assessments of Finances

- Make Use of Cloud-Based Access

- Educate Your Group

- Stay Updated