In real estate investment, managing finances efficiently is important. A leading accounting software, QuickBooks for real estate investors, offers the unique needs of agents. With its user-friendly interface and powerful features, QuickBooks simplifies financial processes, allowing investors to focus more on growing their portfolios.

Let’s delve into how real estate professionals can leverage QuickBooks to simplify their financial workflows effectively.

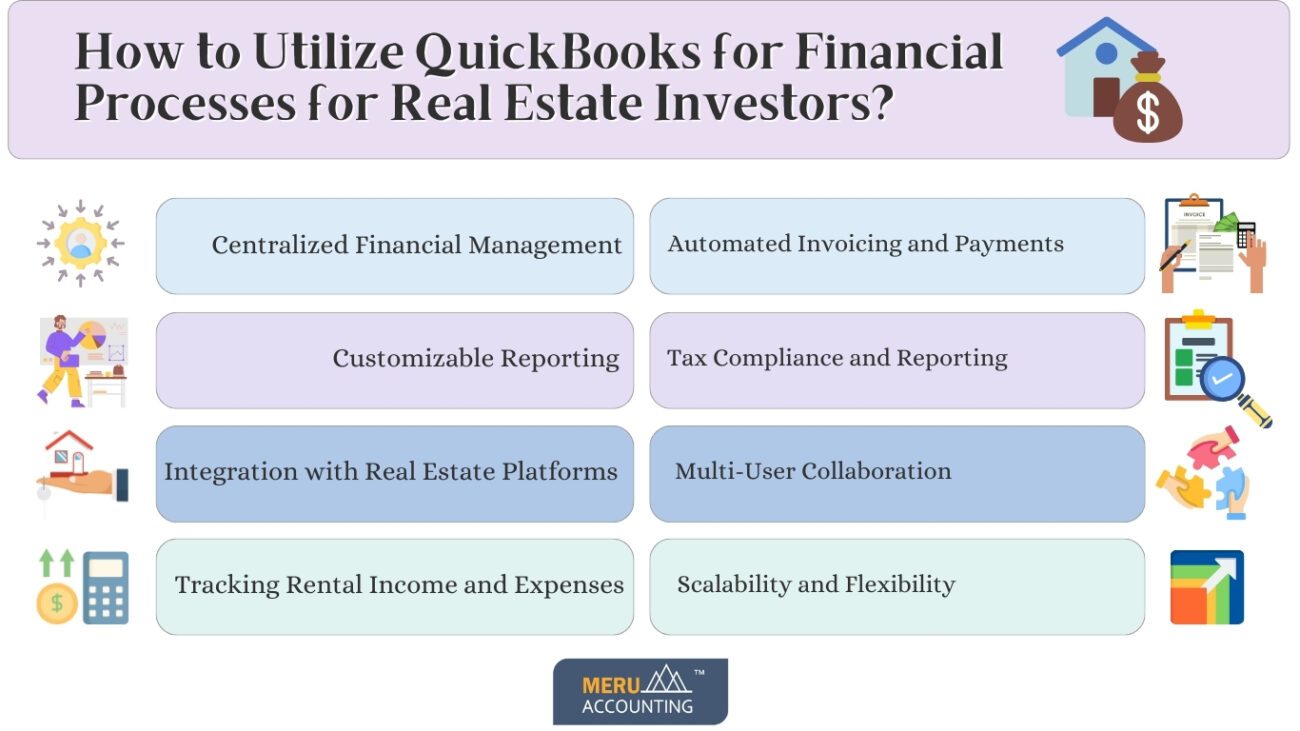

Centralized Financial Management

QuickBooks for real estate agents provides a centralized platform to manage all financial transactions related to real estate investments. Users can effortlessly track income and expenses for multiple properties, ensuring accurate and up-to-date financial records. By categorizing transactions based on property, investors gain valuable insights into the performance of each investment, facilitating informed decision-making.

Customizable Reporting

Real estate investors require detailed reports to analyze profitability, monitor cash flow, and assess property performance. QuickBooks for real estate agents offers customizable reporting tools that enable users to generate tailored financial reports specific to their needs. From profit and loss statements to balance sheets, investors can quickly access key metrics to evaluate the financial health of their real estate ventures.

Integration with Real Estate Platforms

QuickBooks for real estate agents seamlessly integrates with popular real estate platforms, such as property management software and rental listing websites. This integration enables automatic synchronization of financial data, eliminating manual data entry and reducing the risk of errors. By connecting QuickBooks with their preferred real estate tools, investors can streamline workflow processes and enhance productivity.

Tracking Rental Income and Expenses

For real estate investors who own rental properties, tracking rental income and expenses is crucial for maintaining profitability. QuickBooks simplifies this process by allowing users to record rental payments, track expenses such as maintenance and repairs, and generate rent roll reports. Additionally, QuickBooks facilitates the calculation of property-specific metrics like net operating income (NOI) and capitalization rate (cap rate), providing valuable insights into rental property performance.

Automated Invoicing and Payments

Managing invoices and collecting payments from tenants or clients can be time-consuming tasks for real estate professionals. QuickBooks automates these processes by enabling users to create and send invoices electronically, set up recurring billing for rental payments, and accept online payments through various payment gateways. By automating invoicing and payments, investors can improve cash flow and streamline revenue collection.

Tax Compliance and Reporting

Tax compliance is a critical aspect of real estate investing, with numerous tax regulations and deductions applicable to property owners. QuickBooks simplifies tax preparation by categorizing transactions, tracking deductible expenses, and generating tax reports that facilitate filing taxes accurately and efficiently. Additionally, QuickBooks integrates with tax preparation software, further streamlining the tax reporting process for real estate investors.

Multi-User Collaboration

In real estate investment firms or agencies, collaboration among team members is essential for managing financial tasks effectively. QuickBooks offers multi-user access, allowing multiple users to work simultaneously on financial data while maintaining data security and integrity. This feature enhances teamwork and coordination, enabling real estate professionals to collaborate seamlessly on financial processes.

Scalability and Flexibility

Whether managing a small real estate portfolio or a large-scale investment operation, QuickBooks offers scalability to accommodate varying business needs. Users can customize QuickBooks features and add-ons to align with the size and complexity of their real estate investments, ensuring flexibility and adaptability as their business grows. QuickBooks also offers cloud-based solutions, enabling access to financial data anytime, anywhere, from any device.

From centralized financial management to customizable reporting and automated invoicing, QuickBooks offers a comprehensive suite of features to the unique requirements of the real estate industry. By using QuickBooks effectively, real estate professionals can enhance efficiency, improve financial visibility, and achieve greater success in their investment endeavors.

For expert guidance on implementing QuickBooks for real estate businesses, consider partnering with Meru Accounting. Our team of experienced professionals specializes in accounting solutions for real estate investors, helping you optimize your financial processes and maximize your investment returns. Join us today to learn more about our services and how we can support your real estate ventures.