Companies are now increasingly turning to outsource to simplify their operations and focus on their core aspects. One area where outsourcing can be particularly beneficial is reconciliation services. By partnering with a reliable reconciliation outsourcing provider like Meru Accounting, businesses can enhance efficiency, accuracy, and compliance while reducing costs. However, picking the appropriate outsourcing partner needs considerable analysis.

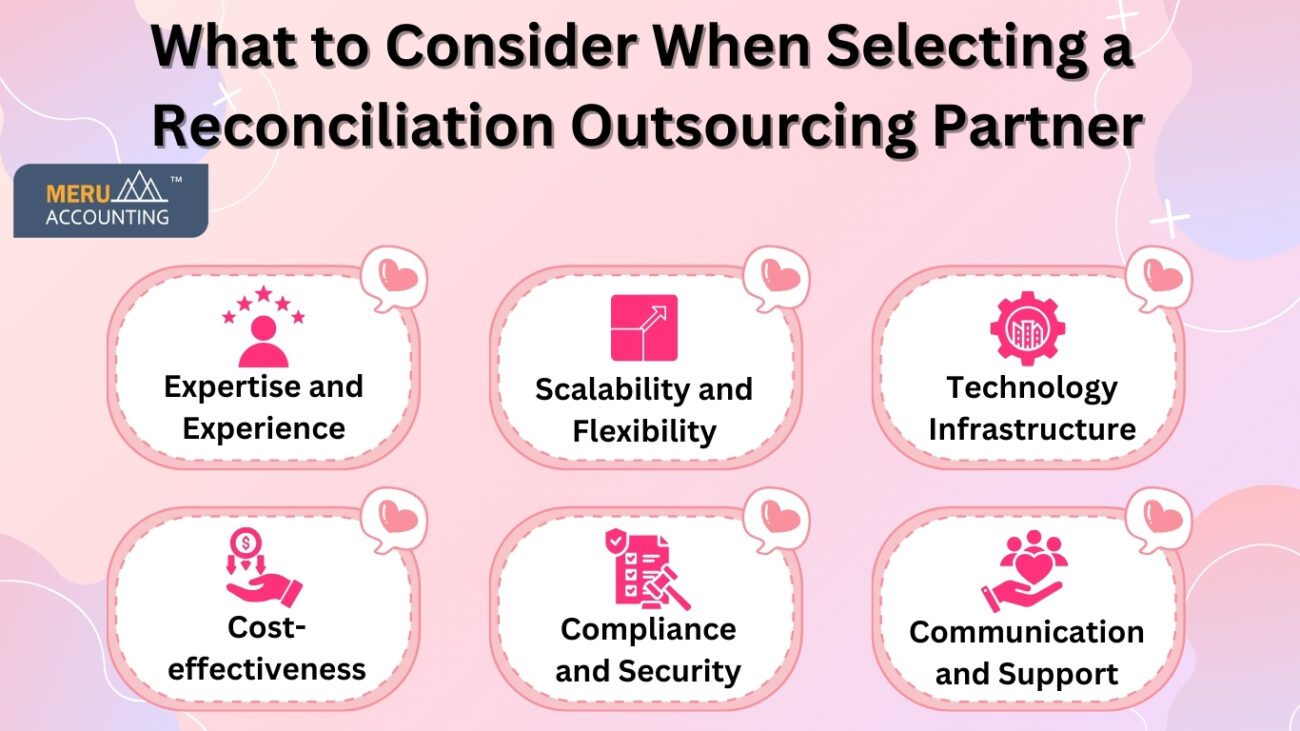

Here are some important points that you must keep in mind:

Expertise and Experience

- When outsourcing reconciliation services, it is crucial to partner with a provider that has extensive expertise and experience in the field. You must outsource reconciliation services to a firm like Meru Accounting, which has a proven track record of delivering top-notch reconciliation services across various industries. Their experience ensures that they understand aspects of your business and can effectively manage complex reconciliation processes.

Technology Infrastructure

- The technology infrastructure of your outsourcing partner plays a significant role in the efficiency and accuracy of reconciliation processes. Ensure that the provider uses advanced reconciliation software and tools to automate repetitive tasks, minimize errors, and expedite the reconciliation process. Meru Accounting employs the latest technology solutions customized to meet the specific needs of its clients, ensuring seamless integration and data security.

Compliance and Security

- Compliance with regulatory requirements and data security are important for reconciliation outsourcing services. Choose a partner like Meru Accounting that adheres to strict compliance standards such as GDPR, SOC 2, and PCI DSS. Additionally, ensure that the provider implements robust security measures to safeguard sensitive financial data and protect against cyber threats.

Scalability and Flexibility

- Your business requirements may evolve, so it’s essential to select an outsourcing partner that can scale their services according to your needs. Meru Accounting offers flexible solutions that can accommodate fluctuations in transaction volumes, seasonal demands, and business growth. Whether you need daily, weekly, or monthly reconciliation services, they can tailor their offerings to align with your requirements.

Cost-effectiveness

- Outsourcing reconciliation services can yield significant cost savings compared to maintaining an in-house team. However, it’s essential to assess the overall cost-effectiveness of the outsourcing arrangement. Look for a provider like Meru Accounting that offers transparent pricing models with no hidden fees. Consider factors such as the quality of service, efficiency gains, and long-term value when evaluating the cost-effectiveness of outsourcing.

Communication and Support

- Effective communication and responsive support are vital for a successful outsourcing partnership. Choose a provider that maintains open lines of communication, provides regular updates on reconciliation processes, and offers prompt assistance when needed. Meru Accounting prides itself on its dedicated client support team, ensuring that clients receive timely assistance and personalized attention whenever required.

In conclusion, selecting the right reconciliation outsourcing partner is crucial for businesses aiming to optimize efficiency, accuracy, and compliance while reducing costs. Outsourcing reconciliation services to a reputable provider like Meru Accounting ensures access to expertise, advanced technology infrastructure, and strong security measures. Their flexible and scalable solutions, transparent pricing models, and responsive client support further enhance the outsourcing experience.

By considering factors such as expertise, technology, compliance, scalability, cost-effectiveness, and communication, businesses can make informed decisions that align with their unique needs and objectives. Outsource reconciliation services to the right outsourcing partner can facilitate enhancing reconciliation processes, mitigate risks, and focus on driving growth and innovation in their core operations.