Tax Planning Services for Small Businesses are essential in the USA to ensure their success. Though it might seem challenging, using effective tax planning strategies can greatly ease the financial burden on your business. By carefully managing your business expenses, taking advantage of available tax credits and deductions, and staying informed about changing tax laws, you can optimize your tax situation and keep more money in your company’s pocket. This proactive approach helps ensure that your small business remains financially resilient and can reinvest in growth opportunities.

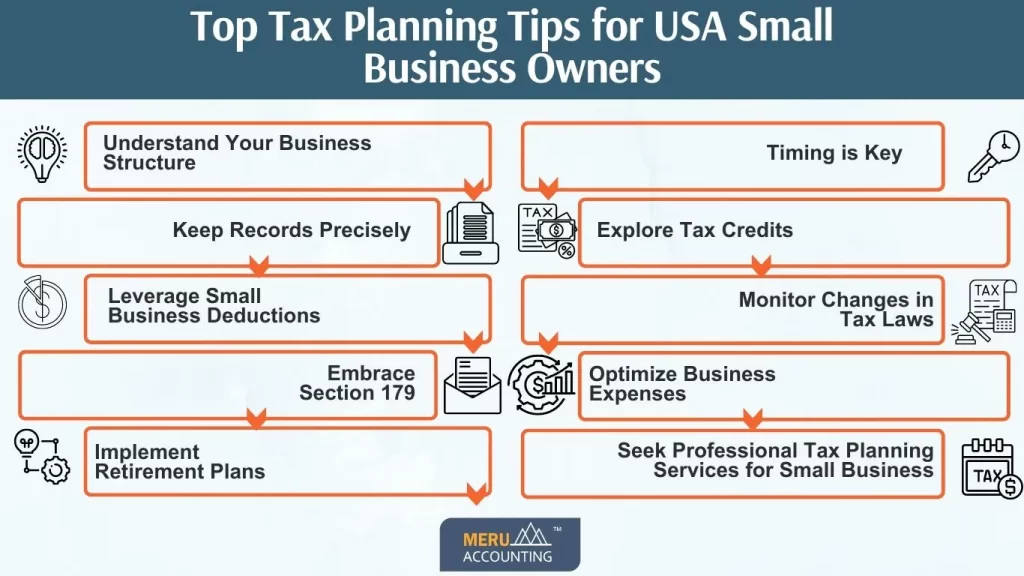

Tax Planning Services Tips

Understand Your Business Structure:

The first step in effective tax planning is understanding your business structure. Whether you operate as a sole proprietor, LLC, S corporation, or C corporation, each structure has unique tax implications. Get advice from a tax expert to figure out the best way to organize your business for the most tax savings.

Keep Records Precisely:

Accurate record-keeping is the backbone of successful tax planning. Keep thorough records of your earnings, costs, and receipts to stay organized. Cloud-based accounting software can simplify this process, making it easier to track transactions and generate financial reports when needed.

Leverage Small Business Deductions:

Take advantage of tax deductions specifically designed for small businesses. Deductible expenses may include office supplies, business-related travel, home office expenses, and health insurance premiums. Identify and claim all eligible deductions to minimize your taxable income.

Embrace Section 179:

Under Section 179 of the IRS tax code, small businesses can deduct the entire cost of eligible equipment and software they buy or finance in the same tax year. Utilize this provision to invest in necessary assets while simultaneously reducing your taxable income.

Implement Retirement Plans:

Contributing to retirement plans not only secures your financial future but also offers immediate tax benefits. Small business owners can explore options like Simplified Employee Pension (SEP) or 401(k) plans, which not only benefit employees but also provide tax advantages for the business.

Timing is Key:

Strategically timing your income and expenses can have a substantial impact on your tax liability. Consider delaying income recognition or accelerating deductible expenses when it aligns with your business’s financial goals. This can help manage your tax bracket effectively.

Explore Tax Credits:

Investigate available tax credits that your small business may qualify for. Credits such as the Small Business Health Care Tax Credit or the Work Opportunity Tax Credit can significantly reduce your tax liability. Stay informed about the latest tax laws to ensure you don’t miss out on potential credits.

Monitor Changes in Tax Laws:

Stay updated because tax laws can change, and it’s important to know about those changes. Regularly monitor updates to the tax code and seek guidance from tax professionals to understand how these changes may impact your business. Adapting your tax planning strategies accordingly can prevent surprises.

Optimize Business Expenses:

Review your business expenses regularly to identify areas where you can cut costs without compromising productivity. Efficient expense management not only improves your bottom line but also minimizes your taxable income.

Seek Professional Tax Planning Services for Small Business:

While implementing these tips is a great start, partnering with professional tax planning services for small businesses can provide invaluable expertise. Tax professionals stay updated with the latest tax regulations, identify personalized strategies, and ensure compliance, ultimately maximizing your tax savings.

Planning your taxes well is really important for small business owners in the USA. If you understand how your business works, you can lower the amount of taxes you have to pay and make more money. Contact Meru Accounting today and enhance your financial stability in your business as we have special services for small businesses to figure out taxes better.