Mastering Invoicing with Simple Steps to Overcome Common Processing Challenges for Small Businesses

Invoicing plays a crucial role in running a successful small business. It is the process of sending out bills or invoices to customers for goods or services provided and receiving payments in return. While it may seem like a straightforward task, many small businesses struggle with invoicing due to various challenges that can arise during the process.

Whether you are just starting your own business or have been running one for some time, mastering invoicing is essential for maintaining healthy cash flow and managing finances effectively.

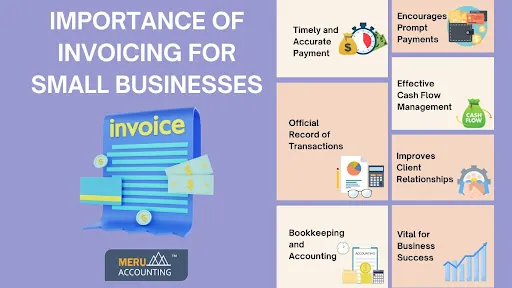

Understanding the Importance of Invoicing

Before diving into the details, it is crucial to understand why invoicing is such an integral part of running a small business. Proper and timely invoicing processing ensures that you get paid for your products or services promptly, which ultimately impacts your business’s financial stability.

Moreover, accurate and organized invoicing not only helps you keep track of your sales but also provides valuable data for financial planning and tax purposes. It also creates a professional image for your business and builds trust with your customers.

Common Challenges Faced by Small Businesses in Invoicing

Now that we have established the significance of invoicing let us dive into some common challenges faced by small businesses when it comes to processing invoices.

Missing Information: Many times, businesses forget to include vital information on their invoices such as payment terms, due dates, or even contact information. This can result in delayed payments or confusion among customers regarding how much they owe.

Manual Errors: With manual invoice processing comes the risk of human error. From incorrect calculations to typos in customer names or addresses, these mistakes can lead to delays in payments and cause frustration for both parties involved.

Disorganized System: Without a proper system in place, tracking invoices becomes challenging leading to missed payments and inaccurate financial records

Late Payments: Late payments can significantly impact a small business’s cash flow and create financial difficulties if not managed properly.

Importance of Invoicing for Small Businesses

Timely and Accurate Payment

- Clear and detailed invoices prevent confusion and delays.

- Maintains positive cash flow and enhances professional image.

Official Record of Transactions

- Provides proof of products or services, agreed-upon prices, and payment terms.

- Essential for quickly resolving payment disputes.

Bookkeeping and Accounting

- Aids in effective financial management for small businesses.

- Provides crucial information for accurate tracking of income and expenses.

Encourages Prompt Payments

- Timely invoicing conveys professionalism and values customer time.

- Builds trust and encourages customers to pay on time in future transactions.

Effective Cash Flow Management

- Helps monitor outstanding balances and facilitates prompt follow-ups.

- Critical for small businesses with limited resources.

Improves Client Relationships

- Creates transparency in billing processes.

- Prevents misunderstandings, fostering better working relationships.

Vital for Business Success

- Implementing invoicing best practices overcomes common challenges.

- Ensures the smooth operation and financial stability of small businesses.

Common Challenges Faced in Invoicing Processing

Implementing invoicing best practices overcomes common challenges.

Invoicing processing is an essential aspect of any business, as it helps to track and manage the cash flow of a company. However, small businesses often face challenges in this process that can lead to delays in payments and affect their overall financial stability. In this section, we will discuss the common challenges faced by small businesses in invoicing processing and provide simple steps to overcome them.

Manual Data Entry Errors:

One of the most common challenges faced by small businesses in invoicing processing is manual data entry errors. This can occur due to human error or inadequate training on proper invoicing procedures. These errors can result in incorrect invoices being sent out to customers, leading to delayed payments or disputes.

Late Payments:

Late payments from clients are another significant challenge faced by small businesses when it comes to invoicing processing. This can significantly impact a company’s cash flow and disrupt its operations if not managed properly.

Disorganized Invoice Records:

Small businesses may struggle with keeping track of their invoice records if they do not have a streamlined system in place. This can result in duplicate invoices being sent out or important documents getting lost, causing confusion and delays in payment processing.

Sales Tax Compliance:

Invoicing for sales tax can be complex and confusing for many small businesses. The ever-changing tax laws and regulations make it challenging to ensure accurate invoicing, leading to potential penalties or fines.

Tips to Overcome Invoicing Challenges

Invoicing is an essential aspect of running a successful business. Efficient invoicing guarantees the receipt of payments for the products or services provided, contributing to the sustenance of a robust cash flow within your business operations.

Use Invoicing Software: One of the most effective ways to overcome invoicing challenges is by using invoicing software. This technology automates the entire process and eliminates human errors in calculations and data entry. You can easily customize invoices with your logo, terms and conditions, and payment methods.

Set Clear Payment Terms: Many small businesses struggle with late payments from clients or customers due to unclear payment terms on their invoices. To avoid this issue, make sure your invoice clearly states the amount due, payment due date, accepted forms of payment, and consequences of late payments (e.g., late fees). This will help manage expectations from both parties and reduce misunderstandings.

Stay Organized: Maintaining proper documentation is crucial for any business process – including invoicing. Make sure to keep track of all your invoices in one place – whether it’s physical files or digital records. This will not only save you time but also prevent any discrepancies or missing information when following up on payments.

Clarify Any Discrepancies Immediately: Invoices may sometimes have errors or discrepancies that need clarification before they can be processed for payment by the client or customer. As soon as you notice any mistakes on an invoice (e.g., wrong amount), reach out to the concerned party immediately to avoid any delays in getting paid.

Follow Up on Overdue Payments: Late payments can significantly affect your cash flow and hinder the growth of your business. It’s essential to have a system in place for following up on overdue payments. You can use invoicing software to send automated reminders or reach out personally via email or phone calls. By being persistent, you increase the chances of getting paid on time.

Benefits of Efficient Invoicing for Small Businesses:

Improved Cash Flow: Timely processing ensures prompt payments, vital for operations and growth.

Reduced Errors: Minimizes mistakes, ensuring accuracy and avoiding payment delays or disputes.

Increased Productivity: Automation saves time, allowing focus on core tasks.

Better Organization: Streamlines financial records for easier tracking and informed decision-making.

Improved Customer Relationships: Professional, timely billing fosters trust and loyalty.

Cost Savings: Reduces manual processing costs like printing and postage fees.

Faster Dispute Resolution: Accurate, timely invoicing minimizes the chances of disputes, saving time and resources.

In conclusion, mastering efficient invoicing is paramount for the success of small businesses. At Meru Accounting, we are committed to supporting clients. By understanding the importance of invoicing and addressing common challenges through streamlined processes and technology utilization, Meru Accounting provides its clients with the benefits of improved cash flow, reduced errors, increased productivity, better organization of financial records, enhanced customer relationships, cost savings, and faster dispute resolution. Partnering with Meru Accounting contributes to the overall growth and success of the firm in providing top-notch accounting services.

FAQs

- Why is invoicing considered crucial for small businesses?

Invoicing is essential for ensuring timely and accurate payments, maintaining positive cash flow, and creating a professional image. It also serves as an official record of transactions, aiding in financial management and tax compliance.

- What are the common challenges faced by small businesses in invoicing?

Common challenges include missing information on invoices, manual errors in processing, a disorganized system for tracking invoices, and the impact of late payments on cash flow.

- How can small businesses overcome manual data entry errors in invoicing processing?

Small businesses can invest in accounting software that automates the invoicing process, reducing the chances of manual data entry errors. These tools often include features like automatic invoice generation and client contact management.

- What steps can be taken to address the issue of late payments?

Small businesses can establish clear payment terms with clients, send timely reminders for overdue invoices, and consider offering discounts for early payments to encourage prompt payments.

- How can small businesses ensure organized invoice records?

Implementing an organized filing system, whether physical or digital, is crucial for maintaining organized invoice records. This includes using cloud-based storage solutions or dedicated accounting software.

- How can businesses navigate the complexities of sales tax compliance in invoicing?

Small businesses should stay informed about the latest tax laws and regulations applicable to their business and seek professional advice from accountants or tax specialists to ensure compliance.

- What are the benefits of using invoicing software for small businesses?

Invoicing software helps automate the invoicing process, minimizing errors, improving cash flow, increasing productivity, organizing financial records, and contributing to better customer relationships.

- How does efficient invoicing contribute to improved cash flow for small businesses?

Efficient invoicing ensures that invoices are processed quickly and accurately, leading to timely payments. This, in turn, improves cash flow, which is crucial for the smooth operations and growth of small businesses.

- How can small businesses minimize errors in manual invoicing?

Small businesses can minimize errors in manual invoicing by transitioning to automated systems, using invoicing software, and implementing clear payment terms to avoid misunderstandings.

- Why is faster dispute resolution considered a benefit of efficient invoicing?

Efficient invoicing, with accurate and timely invoices, reduces the chances of disputes with clients. This ensures that issues are addressed promptly, leading to faster dispute resolution and maintaining positive client relationships.